Summary

- It seems oil has reversed lower after having a superb November.

- I expect oil names could remain rocky through 2021, but the survivors will be very strong.

- EOG Resources has done spectacularly through cycles. Look for the company to keep outperforming.

I assume just about everyone knows the story of Goldilocks and the Three Bears, but here's a quick reminder. A girl sneaks into the house of three bears and starts to eat their porridge, sit in their chairs, and sleep in their beds. Each bear has a different style for each of their belongings, and only one of them fits Goldilocks' preferences "just right". For the porridge, she comes across some that is "too hot", some that is "too cold", and as mentioned, some that is "just right." In this article, I look to show why the largest oil majors are mostly "too hot" for my taste, why small oil producers are "too cold", and why EOG Resources (EOG) is "juuuust right".

Too Hot

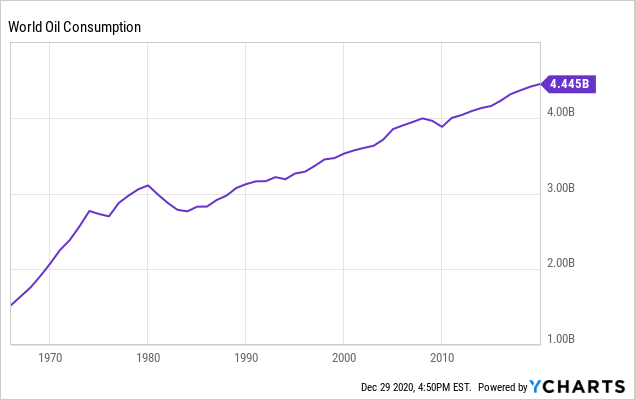

My tendency when I first started looking at oil and gas names a few years ago was to start with the giants, namely Exxon Mobil (XOM), Chevron (CVX), and Royal Dutch Shell (RDS.A, RDS.B). They're known for consistency, growing dividends, and for many decades, superior returns. I still see these as very safe names that will pay a great dividend and will grow slowly, but I no longer think they offer the best overall returns. The way I see it, the world has needed more and more oil to meet demand for decades, and this has served the oil majors better than most:

Data by YCharts

Data by YChartsOil majors, with their easy access to capital and fantastic cost of capital, were the ones that benefitted the most over the "growth" stage of oil that has been happening for decades. They were able to take on big projects, with better return on capital that smaller companies couldn't fathom taking on. They also were better positioned to survive the cycles and even benefit from them, as they had the balance sheet flexibility to buy up assets on the cheap. Even though oil majors have had a decided advantage for decades now, I see this as drawing to a close based on the fact that I think growth will at least slow, if not come to a halt.