Summary

- ConocoPhillips has an impressive portfolio of assets augmented by its Concho Resources acquisition and its recent discoveries.

- The company managed to handle 2020 with impressive cash flow, covering all of its expenses and 25% of its shareholder rewards, with low prices.

- Going forward, the company should breakeven in 2021 at $39 WTI and generate strong shareholder rewards and growth past that.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

ConocoPhillips (NYSE: COP) recently announced another massive discovery in the Norwegian sea. The midpoint size on this discovery is nearly 140 million barrels, which across a 10-year production lifecycle, would mean almost 40 thousand barrels / day in potential production. This discovery alone has the potential to increase the company's production by several %.

As we'll see throughout this article, the company's asset base along with its breakeven and growth potential make the company a high potential investment.

ConocoPhillips and Concho Resources

ConocoPhillips is a massive $40 billion company that took advantage of the COVID-19 related downturn to acquire Concho Resources. The near $10 billion acquisition is a massive acquisition for ConocoPhillips and enables the company to significantly expand its shale resources. These low cost shale resources should generate the company strong returns.

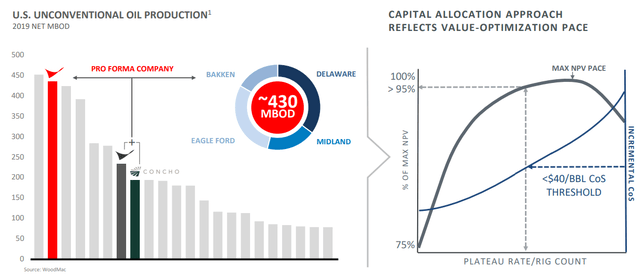

ConocoPhillips with Concho Resources - ConocoPhillips Investor Presentation

The combined company will have unconventional production of 430 thousand barrels / day, a near doubling in unconventional oil production. It'll come with more than 1.5 million acres with ~17 thousand remaining drilling locations at a less than $40 cost of supply. This unconventional asset position, with a low cost asset base, should support strong long-term cash flow.