Summary

- iHeartMedia continues to rebound as business returns heading into 2021.

- The company continues to grow the podcasts business which has the potential to monetize at much higher rates.

- The stock is cheap trading at ~7x normalized adjusted EV/EBITDA.

- This idea was discussed in more depth with members of my private investing community, Out Fox The Street. Get started today »

The strong earnings rebound in Q3 and the potential economic rebound in 2021 sets up iHeartMedia (IHRT) for a big year. The stock is still down substantially from pre-virus highs while revenues are set to quickly eclipse pre-virus levels due to surging podcast demand. My investment thesis remains bullish on the stock rebounding to top 2020 highs in 2021.

Image Source: iHeartMedia website

Bounce Back

The Q3 results showed a remarkable rebound for iHeartMedia. Ad revenue was crushed during the initial COVID-19 lockdown during Q2, but revenues are rebounding quickly led by digital sectors such as podcasting.

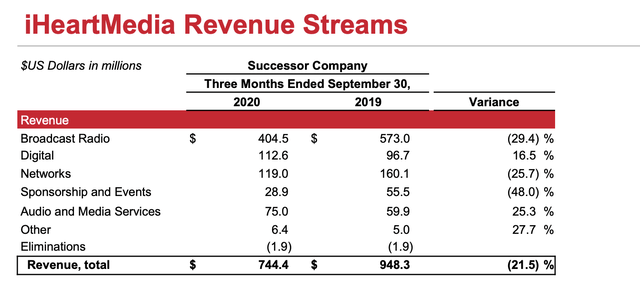

In total, revenues hit $744 million, up from only $488 million in the prior quarter. The company still saw revenues down 21.5% YoY, but the September revenues were only down 18%.

Source: iHeartMedia Q3'20 presentation

Even with revenues still down 21.5% in the quarter, iHeartMedia managed to produce positive free cash flows of $14 million wile producing adjusted EBITDA of $162 million. The worse of the crisis is over and the media company can now focus on building a digital empire while returning their broadcast radio network back to normal levels.

With net debt topping $5.3 billion, iHeartMedia was a risky play in the middle of the crisis. As the vaccines roll out in the next few months, the dire outcome is eliminated from the investment story allowing for substantial stock upside.