Summary

- Activist shareholders are driving change.

- The hope is to unlock value by separating Eagle's business segments.

- Higher valuations must be weighed against greater risks.

As recently as this past spring, Eagle Materials Inc. (EXP) was a conglomeration of Heavy Materials, Light Materials, and Oil & Gas Proppant businesses. Now, Eagle has divested its energy related assets and, after making a significant acquisition and a minor divestment in its Heavy Materials business, is in the midst of separating itself into two independent companies. This evolution is potentially an opportunity for investors to capitalize on the unlocking of value.

The Transactions

In response to input from its largest shareholders, Eagle initiated a strategic review of its businesses in April of 2019. Less than a month later, the company announced that Sachem Head Capital Management, one of its largest shareholders providing the initial push for change, had submitted two nominations for seats on the board of directors and proposals to the company for the creation of value.

In the same month, Eagle announced its plan to separate the Heavy Materials business from the Light Materials business while exploring 'alternatives' for its lagging Oil & Gas Proppants business. Sachem Head approved of the plan, and concurrently withdrew its nominees and proposals. The separation was initially targeted for the first half of 2020.

Six months later, in late November 2019, Eagle increased its commitment to its Heavy Materials segment by agreeing to acquire a cement plant and related assets from Kosmos Cement Company.

In February of 2020, the company took a step toward the separation by naming the respective CEO and Chair of each business. Then COVID-19 hit and the timing of the separation became uncertain as the company in April 2020 suspended its next dividend, took measures to preserve cash, and extended the maturity of its term loan. At this time, the company recommitted to the business separation plan which it then reaffirmed on the Q221 (ended 9/30/20) call at the end of October.

Also in April of 2020 Eagle sold its Western Aggregates and Mathews Readymix operations which it deemed 'non-core' Heavy Materials assets. Finally, in September of 2020, Eagle sold its Oil & Gas Proppants business to Smart Sand Inc. (SND).

The Kosmos acquisition was for $665M, or about 3.9x 2019 revenue of $170M. Eagle as a whole currently trades for about 2.6x revenue, with its cement segment making up about 40%. Per ton revenue for Kosmos, based on 1.7 million tons of capacity in 2019, is $100. This lags Eagle's Cement segment which in 2020 (ended 3/31/20) had about $123/ton in revenue. The $100/ton figure for Kosmos does not incorporate expected synergies from the integration with Eagle's business.

The sales of the Western Aggregates and Mathews Readymix operations were relatively minor at just $93.5M, and the sale of the Oil & Gas Proppants business was very small at just $2M. The Oil & Gas Proppants business was sold for shares in acquirer Smart Sand rather than for cash. This business has recorded operating losses totaling $140M since it began operations in 2014 thus its sale will immediately boost profitability.

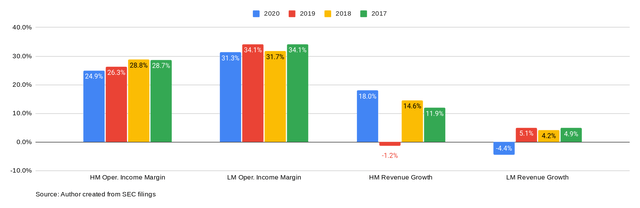

The Light Materials business is more profitable than the Heavy Materials business. Revenue in the Heavy Materials business has grown by about 49% since 2016, largely due to acquisitions, whereas the Light Materials business has grown its revenue by less than 10% during that span.

Sectors and Segments

Eagle's two businesses are each made up of two segments with varying attributes. The Heavy Materials sector is made up of its Cement segment and its Concrete & Aggregates segment. Cement is vastly more profitable while Concrete & Aggregates has grown more quickly since 2016.