Summary

- Vistra Corp.’s gross profit margin leapfrogged to 45.8% in Q3 2020, from 34.8% in Q3 2019. The company has already reaffirmed its 2021 guidance and is on track to achieve.

- The company has also committed to cut debt by $550 million between now and 2022, and has already started reporting a significantly lower interest expense.

- It is adapting to the post-COVID-19 era by shifting to green and low-emission (natural gas) sources of power, and I am bullish on it as a long-term investment.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

We believe that electricity exists because the electric company keeps sending us bills for it, but we cannot figure out how it travels inside wires.

? Dave Barry

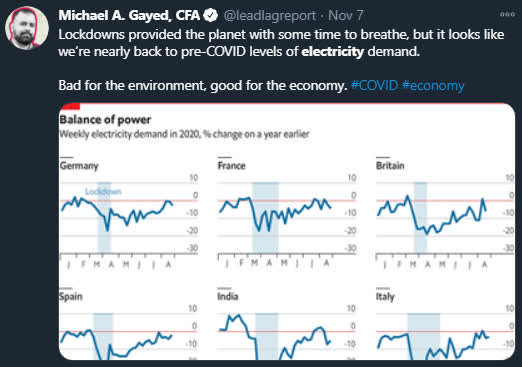

Vistra Corp. (VST) is a holding company whose subsidiaries are engaged in an integrated retail and electric power generation business, mostly in the U.S. markets. After getting impacted by COVID-19, electricity demand inched up back to pre-COVID-19 levels in November 2020. Though the virus is still on the loose, safe and effective vaccines have recently been launched and it should be a matter of time – let’s say, 8 to 10 months – before the virus is fully contained.

Image Source: My Tweet / The Lead-Lag Report

Despite the virus being on the loose, VST has already reaffirmed that the upper end of its 2021 non-GAAP guidance of $3.47 billion EBITDA, 60% of which will convert to free cash flows before growth, is achievable. The company is also preparing aggressively for the post-COVID-19 era. It owns a portfolio of green and low-emission natural gas assets, and is planning to retire a majority of its coal plants and transform into a “greener” enterprise.

The company, which got listed in 2017, has delivered so far on revenues and profits, and its future looks good and green. All that remains to be done is to analyze its financials. So, let’s do that:

Profitability

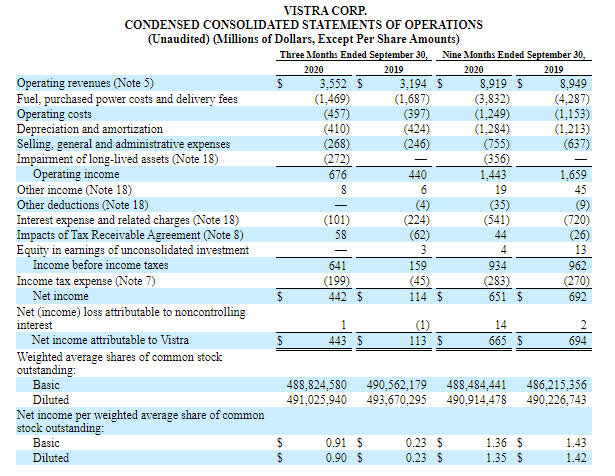

Image Source: VST’s Q3 SEC Filings

VST Q3 2020 revenues ($3.5 billion) rose 11% year over year despite the massive COVID-19 disruption in 2020, a very encouraging signal indeed. Its gross profit margin (sales less fuel costs less operating costs)/sales) jumped to 45.8% from 34.8% year over year. This increase was made possible by optimizing the fuel costs and the delivery fees.

The interest expense fell to $101 million in Q3 2020 as compared to $224 million in Q3 2019. The lower fuel costs and lower interest expense helped the company report a net income of $442 million in Q3 2020. It was a massive increase, considering that its net income was just $113 million in Q3 2019.

What’s even more encouraging is that VST’s 2021 and 2022 plans have factored in a debt reduction of about $550 million. Investors can expect the interest expense to keep falling in the quarters ahead. The management team has also promised to return a majority of its free cash flows of about $2 billion to shareholders through dividends and share buybacks. The management team also opines that the company has the lowest retail cost structure in the country, and its operations are super-efficient. I too believe that the company’s profitability will improve over time.