Summary

- Vistra offers investors exposure to ESG-friendly growth at a very compelling valuation.

- The portfolio rebalance towards renewables is underway and should unlock ample value creation opportunities given the higher project-level return profiles.

- The FCF engine is in full flow and should continue to support capital return via deleveraging, dividends, and buybacks going forward.

- At an >20% fwd FCF yield (~18% fwd recurring FCF yield) and a potential IG upgrade catalyst, the stock offers good value.

At current valuations, I think Vistra (VST) represents an attractive vehicle for investors to gain exposure to ESG-friendly growth. Not only is the company rebalancing its portfolio toward renewables, but it also continues to generate a stable free cash flow stream, which seems to be underappreciated by Mr. Market. The strong FCF generation outlook translates into a compelling capital allocation plan, with strong EBITDA generation of >$3bn/year and an ~60% FCF conversion driving opportunities across debt reduction and buybacks. At the current implied fwd FCF yield of >20% (~18% fwd recurring FCF yield), VST leaves investors with many ways to win.

Rebalancing the Portfolio Towards Renewables

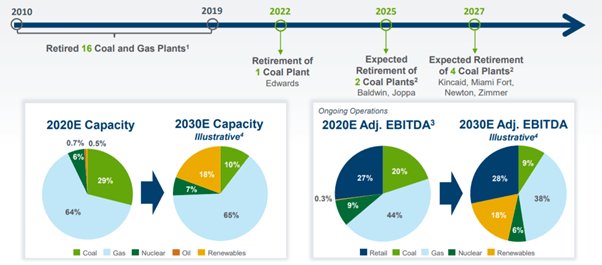

At its recent analyst day, the company outlined a path toward coal-fired assets contribution declining to <10% of total EBITDA by 2030 (from ~20% now), with a net-zero emissions goal established for 2050. These targets entail the retirement of 6.8GW of coal capacity through 2030 and an increase in renewables contribution to ~18% (from 0.3% currently). Recent retirements (e.g., the 650MW single-unit coal-fired plant in Fannin, TX) signal intent as management executes on its portfolio transformation and emission reduction goals.

Source: Investor Presentation

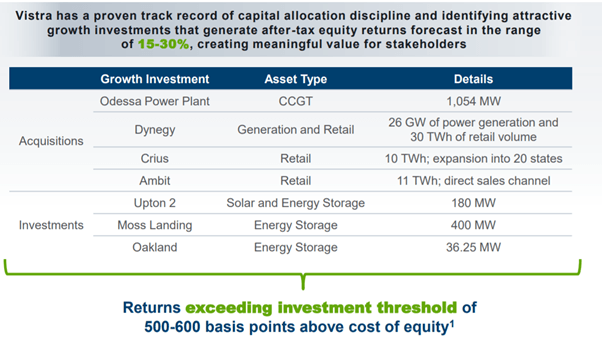

That said, there remains some way to go on the portfolio transformation front - the relative scale of recent gas plant closures, for instance, implies a negligible impact on fwd FCF estimates through FY22. But there are further retirements in the pipeline - VST is also looking to retire two single-unit gas assets in TX, Wharton (83MW) and Trinidad (244MW), on account of the challenging pricing environment, which cumulatively could weigh on FCF. I am not concerned though, as the benefit from VST's long-term shift to renewables should more than offset any coal-related headwinds. Per management, targeted project-level returns are in the 15-30% range for renewables, well above the current high-single-digits % ROIC for the company. Plus, there's upside optionality from the potential implementation of a carbon tax, with a higher terminal value for renewables assets also likely to boost the valuation.

Source: Investor Presentation

On Track for the Upper-End of FY21 Guidance

VST still sees the upper-end of its guidance range as achievable for FY21, as continued COVID-driven market volatility introduces some attractive forward hedging opportunities. The slight drawback is that renewables deployment has likely been delayed due to the pandemic, even though Electricity Reliability Council of Texas (ERCOT) area demand has recovered to pre-COVID levels. That pushes the renewables timeline back by about a year, but expect a tighter supply/demand balance in FY21 to offset this somewhat. Further, residential demand could also stay elevated if work from home conditions persist into FY21, driving an upward bias to the guide, with scarcity events also worth keeping an eye on.