Summary

- CNK's share price doubled in the month of November.

- Q3 revenue was staggeringly low yet not unexpected.

- Strategically built a cash buffer through operational cuts, CARES benefits and financing efforts.

- Making moves to instill confidence in safety, enhance the consumer experience and improve the future flow of movies.

There has been a lot written about the horrible effect COVID inflicted on virtually every industry that requires social gatherings. The narrative seems to be going into rerun mode as another wave of COVID cases is upon us. However, I think investors may be in for a surprise as this isn't a replay of the pandemic's impact on share price, it's actually a sequel with a twist in plot. In this sequel, the protagonist, Cinemark (NYSE:CNK) is ready to bring the fight to the villain, COVID.

We all know how the first episode played out as it was clearly the most watched event in a hundred years. The pandemic came in like a tsunami, forcing the most buoyant of companies under water. Now, the plot thickens as wave two is upon us, but this time Cinemark is ready as they've built a raft of cash to stay afloat.

Price action and technical breakout

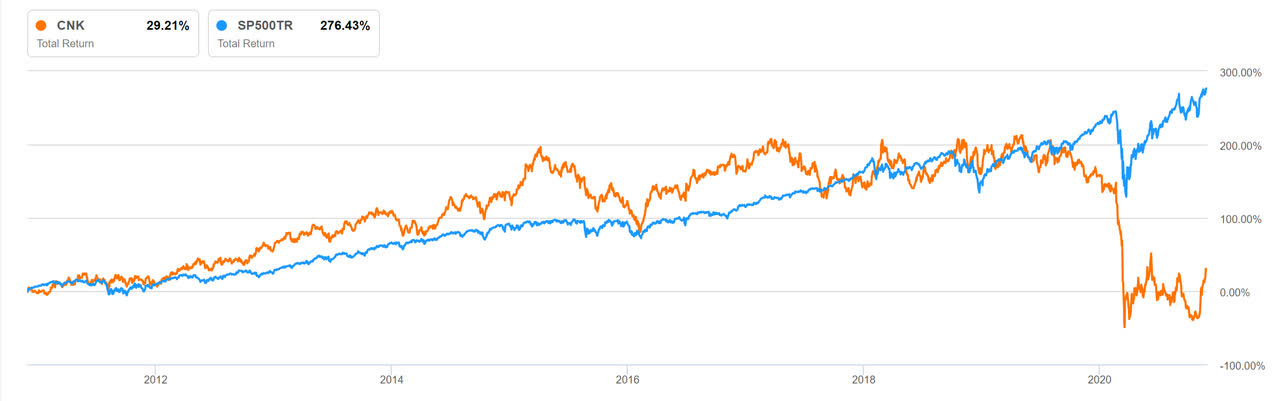

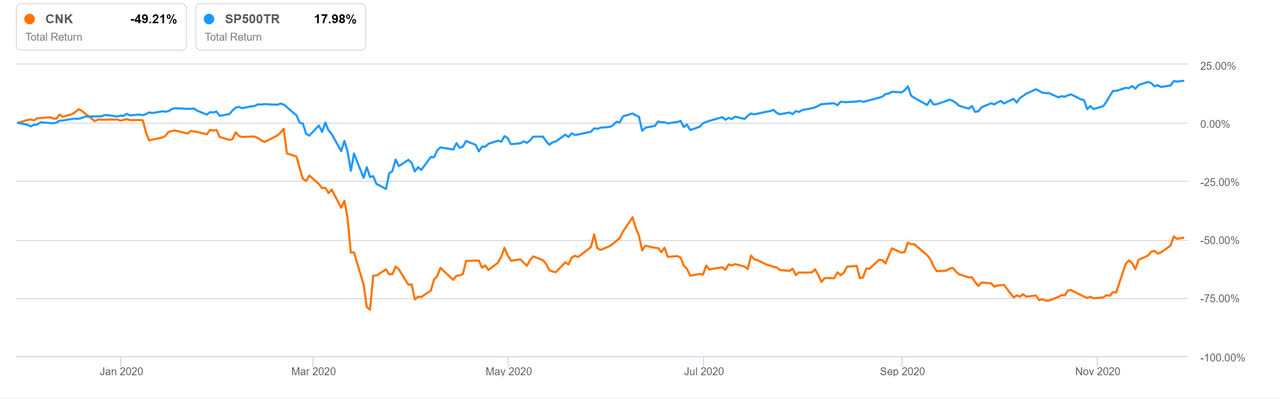

Historically speaking, Cinemark has followed the trajectory of the S&P 500 as shown in the 10 year total return chart below. A closer look at the 1 year chart shows the beginning of the negative divergence in January when we were hearing the early rumblings about the virus as it began to spread in a far away land. By mid March the first wave engulfed the World.

The widening of this negative divergence continued as the months ticked by. The S&P 500 began recovery immediately following the March drop. However, CNK spent the following months channeling between $8 and $19. In fact, the S&P 500 returned to and flew past pre-COVID levels. With the S&P 500 returning to the pre-COVID trajectory, CNK is just now looking to exit the channel created from the March dive.

Source: SA total return CNK and S&P 500 10 year chart

Source: SA total return CNK and S&P 500 10 year chart

Source: SA total return CNK and S&P 500 1 year chart

Source: SA total return CNK and S&P 500 1 year chart

Now with the second wave beating down hard, CNK's share price isn't reacting negatively, which most likely signals that the market has confidence in survival. There is a clear and defined move when looking at the November 1 month chart below. A brash almost defiant push upwards occurs aggressively on November 7th, likely from the vaccine news catalyst. As the month progressed and the pandemic's second wave strengthened, Cinemark's resolve to fight back remained unwavering. In fact, the November move was so great that CNK doubled in the face of rising COVID cases as shown below.