Summary

- GILD's Q3 revenue bounced Q/Q on the strength of its COVID-19 treatment.

- HIV revenue gained traction as the economy continued to reopen. Sizeable M&A deals may have reduced GILD's dry powder.

- It is unclear whether investments in GLGP and IMMU will generate an acceptable financial return.

- Questions loom for GILD. I rate the stock a hold.

- This idea was discussed in more depth with members of my private investing community, Shocking The Street. Get started today »

Source: Barron's

Source: Barron's

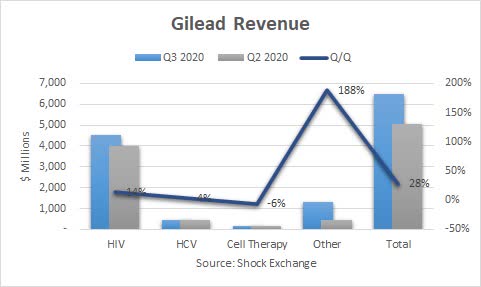

Gilead (NASDAQ:GILD) reported Q3 revenue of $$6.56 billion, non-GAAP EPS of $2.11 and GAAP EPS of $0.29. The company beat on revenue and non-GAAP EPS, but missed on GAAP EPS. Q2 revenue fell in the high-single-digit percentage range Q/Q, as Gilead was negatively impacted by the pandemic. Revenue came roaring back this quarter, rising 28% sequentially and falling 10% Y/Y.

HIV revenue was $4.5 billion, up 14% Q/Q. Channel inventory began to normalize, driving sales higher. Biktarvy sales were $1.9 billion, up 18% Q/Q. This was a sea change from the 5% decline last quarter; Q2 was marked by reduced switches due to a decline in patient visits amid the pandemic. Biktarvy has been a catalyst for HIV sales and Gilead in general. It has been cannibalizing certain of Gilead's HIV products as well as those of competitors.

HIV revenue was $4.5 billion, up 14% Q/Q. Channel inventory began to normalize, driving sales higher. Biktarvy sales were $1.9 billion, up 18% Q/Q. This was a sea change from the 5% decline last quarter; Q2 was marked by reduced switches due to a decline in patient visits amid the pandemic. Biktarvy has been a catalyst for HIV sales and Gilead in general. It has been cannibalizing certain of Gilead's HIV products as well as those of competitors.

HCV revenue of $464 million rose 4% Q/Q as the segment recovers from delayed patient starts due to the pandemic; an increase in Europe also helped. Cell Therapy revenue was $47 million, down 6% Y/Y. The segment included $9 million from Tecartus, which received FDA approved this quarter.