Summary

- Rackspace Technologies is a pureplay multicloud service provider that enables customers to manage their cloud platforms.

- The company has built its proprietary software called Rackspace Fabric with over 1bn USD of investment, which enables clients to migrate their workflows and applications to the cloud.

- COVID-19 has created a secular tailwind for Rackspace’s software and consulting services resulting in large demand for its services.

- Fair valuation for this stock should be ~$28.3utilzing a forward EV/uFCF of ~22x inline with comparables representing a 70% upside from the current prices.

- Key Strengths include: market leader in pureplaymulticloud services, proprietary technology and strong technological moat. Key Risks include: intense competition and high leverage.

Investment Thesis

After a negative price reaction after going public in July'20, Rackspace is currently significantly undervalued compared to its peers. COVID-19 has created secular tailwinds for the cloud services industry, and Rackspace is well-positioned to capture this demand.

History

Rackspace is a multicloud technology services company that was founded in 1998. Their technology platform enables customers to manage private and public multicloud environments.

Initially Rackspace focused on selling its cloud products (i.e OpenStack Public Cloud) to its customers. However, the cloud offerings by competitors such as AWS, Google and Microsoft created a highly competitive environment for Rackspace.

Rackspace had gone public in 2009 and was taken private in 2016 by Apollo group (around the time when the cloud service market got highly competitive). During the 2016-2020 period, Rackspace transitioned itself from competing with the likes of AWS, Google and Microsoft to enabling customers to adopt their products. Rackspace positioned itself as a technology service company that enabled customers to transform their workloads to the cloud, build new cloud products and modernize applications on the cloud.

Over time, companies started adopting more than one cloud platform for their applications, and Rackspace developed its consulting and technical capabilities in optimizing for multicloud solutions. Today, Rackspace offers multicloud solutions irrespective of their customers technology stack or deployment model. They have deep partnerships with major technology platforms and strong partner relationships. Rackspace has dedicated 12 million hours and over 1bn dollars in developing their proprietary technology platform.

Rackspace eventually went public in mid-2020 during the COVID-19 Pandemic. The pandemic has served as a strong tailwind to Rackspace’s product offerings as customer flocked towards cloud solutions. Given the complexity of multi-cloud solutions and lack of in-house IT cloud resources, Rackspace has seen a surge in demand during the last quarter. This has been reflected in their Q2’20 bookings.

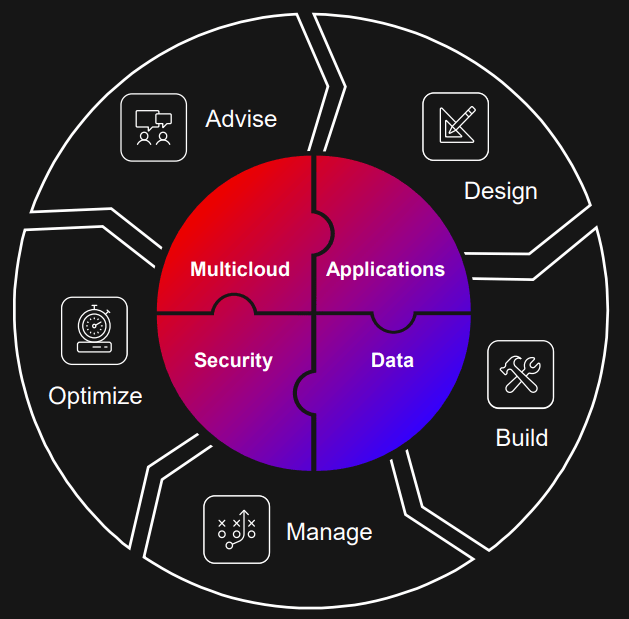

Rackspace’s typical customer journey consists of the following phases:

Source: Rackspace Technologies Q2’20 Presentation

1. The Advise Stage: Rackspace Technology provides initial advisory and support including cloud readiness assessment.

2. The Design Stage: The Company creates a detailed plan and timeline on how it can move the clients workloads to the Cloud.

3. The Build Stage: The Company helps the customer build its technology environments and move workloads across a different mix of cloud providers and deployment models.

4. Manage Stage: Rackspace operates a B2B SAAS model where it continues to maintain the customers cloud applications post building and deployment.

5. Optimize Stage: Over the long term, Rackspace aims to follow its strategy of “Land and Expand”. They company aims to continuously meet its customer requirements of cost reduction and scalability by embracing emerging technology.