Summary

- Valero Energy's revenue for the third quarter was $15.809 billion. The company came out with a quarterly loss of $1.14 per share.

- During the quarter, refining throughput volumes were 2.526 million barrels per day.

- Valero Energy continues to be a long-term investment, despite the recent drop in stock price.

- Looking for a helping hand in the market? Members of The Gold And Oil Corner get exclusive ideas and guidance to navigate any climate. Get started today »

Courtesy: Tank News International

Courtesy: Tank News International

Investment Thesis

San Antonio-based Valero Energy Corp. (NYSE: VLO) released its third-quarter results on October 22, 2020. The company posted a loss this quarter but not as severe as the market was expecting.

Renewable diesel sales volumes and lower corn prices in the Ethanol segment helped. Diesel, gasoline, and jet fuel demand was higher and suggested a possible demand recovery. However, with the pandemic's second wave in progress now, a sustainable recovery may be pushed to H1 2021 at the earliest. Overall, lower refinery throughput volumes and ethanol production were to blame for the loss.

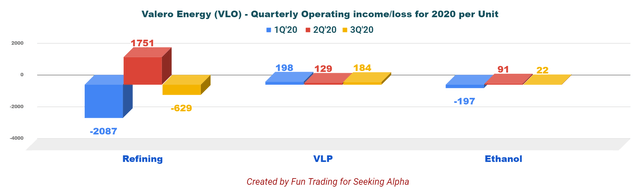

Notably, operating loss at the Refining segment was $629 million compared to a profit of $1,087 million in the same quarter last year. The chart below is indicating three quarters of operating income.

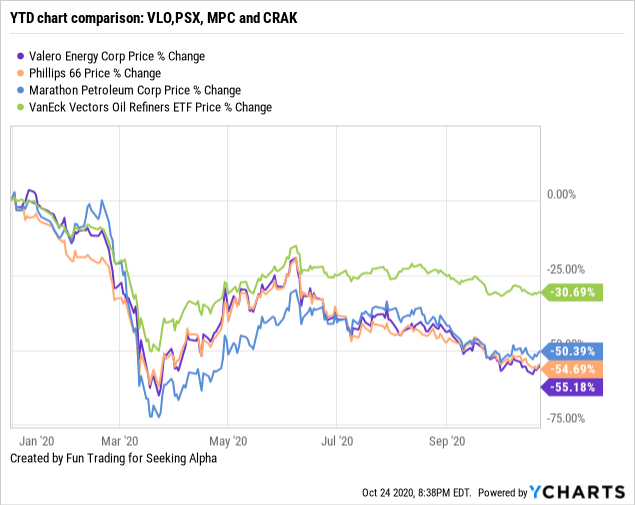

A look at the one-year chart places Marathon Petroleum (NYSE:MPC) slightly ahead of the group, but all of them underperformed the VanEck Vectors Oil Refiners ETF (NYSEARCA:CRAK) by a large margin. Valero Energy seems the most affected right now.

Data by YCharts

Data by YChartsThe margin comparison per barrel of throughput and ethanol from the third quarter of 2020 compared to the same quarter a year ago is shown below.

The refining margin per barrel of throughput decreased to $4.10 from the year-ago level of $10.00, while the ethanol margin increased from $0.27 to $0.47.