Summary

- We recently said we were starting to buy up SLB again.

- Q3 earnings were slightly mixed but the stock got slammed, as did the entire energy sector despite crude oil prices being stable Friday.

- Not out of the woods yet but we are accumulating.

- Great cost cutting work has been accomplished.

- This idea was discussed in more depth with members of my private investing community, BAD BEAT Investing. Get started today »

- Prepared by Tara, Senior Analyst BAD BEAT Investing

We have traded Schlumberger (SLB) many times at our firm, and we started buying up the stock once again on recent weakness. As we mentioned, there was a lot to look forward to in the Q3 report. Things seem to be just starting to balance out for the oil space this week price wise but we are by no means 'out of the woods' yet for lack of a better expression. Demand erosion persists, and there is more than ample supply still. The company just reported Q3 earnings, which we had predicted (with a hint of the obvious) would be rough. In this article, we discuss the strengths and weakness in the key metrics we follow. We plan to add aggressively under $15 per share with a long-term outlook.

Revenues

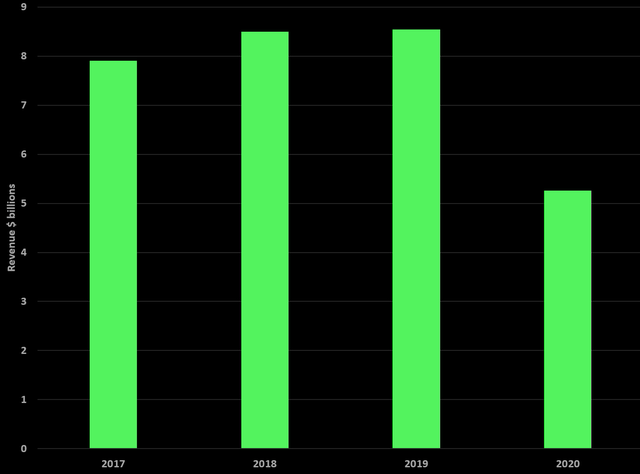

We saw revenues declining sizably in Q3 on this but had some wide expectations. Admittedly, expectations from opinion makers and analysts were all over the map. We saw revenues coming in lower on the devastating decline in pricing and demand. We thought down 30%-40% was a solid base to work off of, revenues ended up coming in down toward the lower end of this range, and breaking a nice Q3 trend of revenue:

Source: SEC filings, graphics by BAD BEAT Investing

Make no mistake, Q4 will be tough too, but not as poor as Q3. We think operational performance bottomed in Q2. Pricing has started to rebound recently this week, but is still weak. With the cut in revenues, we are pleased to see management cutting expenses too. But revenues were $100 million below what we thought we would, and missed consensus by $110 million. Revenues were down 38.4% as a result versus last year. This is a pretty sharp decline but with oil prices still at about decade lows no one can be surprised here. As we wait for real demand to return, the company is back to cutting expenses to the bone like we saw five years ago.