Summary

- Penn Virginia is a small company operating in a very oil-rich area of the Eagle Ford shale.

- The company's production is almost entirely oil, which could prove to be a weakness in today's environment.

- The company is still able to produce profitably even today.

- It appears to be very well-managed and has a reasonable level of debt.

- The company is incredibly cheap, so could provide investors with an appealing opportunity.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Get started today »

Penn Virginia Corporation (NASDAQ:PVAC) is an independent oil and gas company engaged in the exploration, development, and production of oil, natural gas, and natural gas liquids. The company bills itself as operating in a variety of basins, but in actuality, it focuses exclusively on the Eagle Ford Shale in Texas. As is the case with most companies in the energy industry today, Penn Virginia Corporation’s stock price has been severely battered by the low energy price environment, which some aggressive investors may actually find attractive. In this article, we will examine the company in an attempt to determine if the stock is a good investment for us today.

About Penn Virginia Corporation

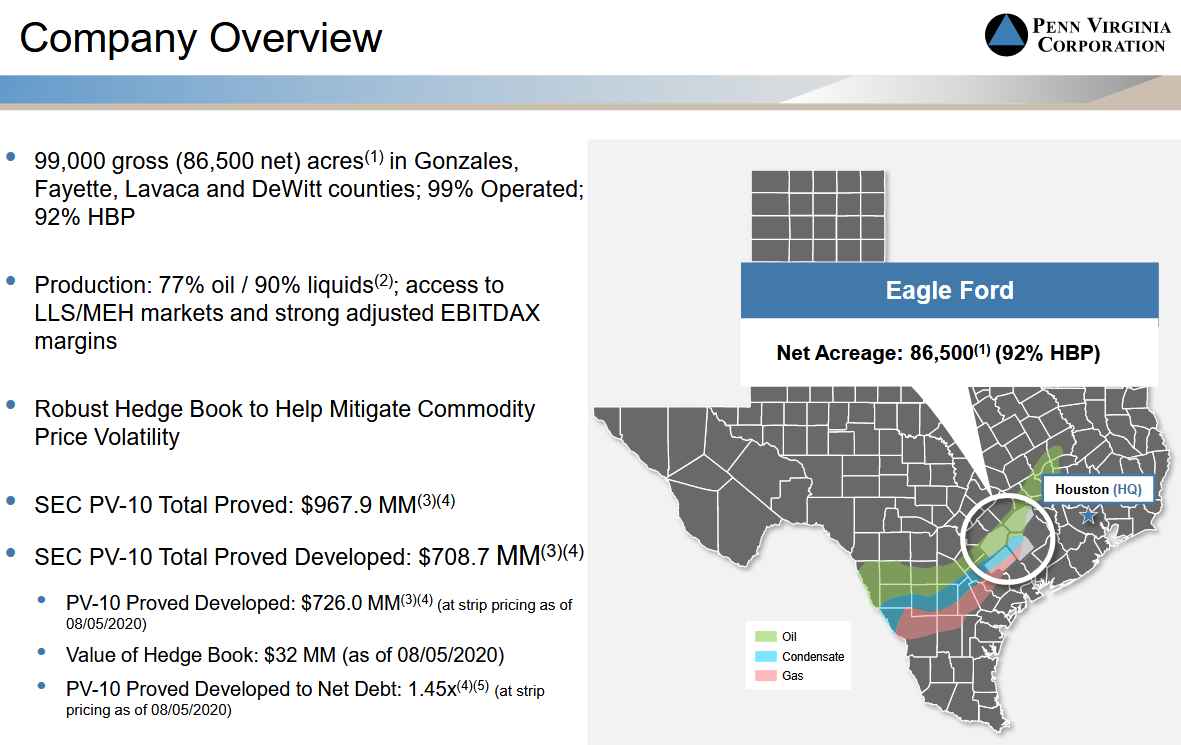

As just mentioned, Penn Virginia Corporation is primarily active in the Eagle Ford shale in South Texas. The company possesses 86,500 net acres in the region:

Source: Penn Virginia Corporation

Admittedly, this is not nearly as much acreage as some other companies have. This is reflected in the company’s relatively modest market cap of only $149.8 million. Of course, just because a company is small does not mean that it cannot be a good investment. Indeed, many investors devote a great deal of effort towards seeking out undervalued small caps as they can offer more potential upside. In the case of a small independent company like this, one thing that we want to consider is the quality of the company’s acreage. There is reason to believe that Penn Virginia’s acreage is quite resource-rich, although it may not be as good in the current environment as it once was.

Prior to the coronavirus pandemic, many analysts and investors preferred companies that produced a sizable proportion of liquids, especially crude oil. This is because oil prices were reasonably high while natural gas prices were suppressed. This has been the case for quite some time. However, in today’s pandemic-stricken world, natural gas prices have held up much better than oil prices have. This is because natural gas is still heavily in use to heat homes and businesses that are still open, while there is much less need for crude oil as a transportation fuel when people are hesitant to travel. Penn Virginia Corporation produces mostly liquids. We can see this by looking at the company’s second quarter 2020 production profile, which was 90% liquids, 77% of which was crude oil: