Summary

- As stock markets continue to trade near long-term highs, income investors are looking for undervalued Dividend Aristocrats that are still trading at favorable levels.

- AT&T’s long history of dividend payouts has reached a pivot point where the stock yields are attractive enough to justify the potential risk of further declines in share price values.

- Strategic catalysts could develop if AT&T is able to sell its problematic DirecTV unit and this might generate bullish tailwinds for AT&T in coming quarters.

- Despite the recent declines in share prices, we rate AT&T an undervalued “buy” based on its long-term stability as a dividend grower and price analysis signals that highlight the potential for a near-term bottom in the current downtrend.

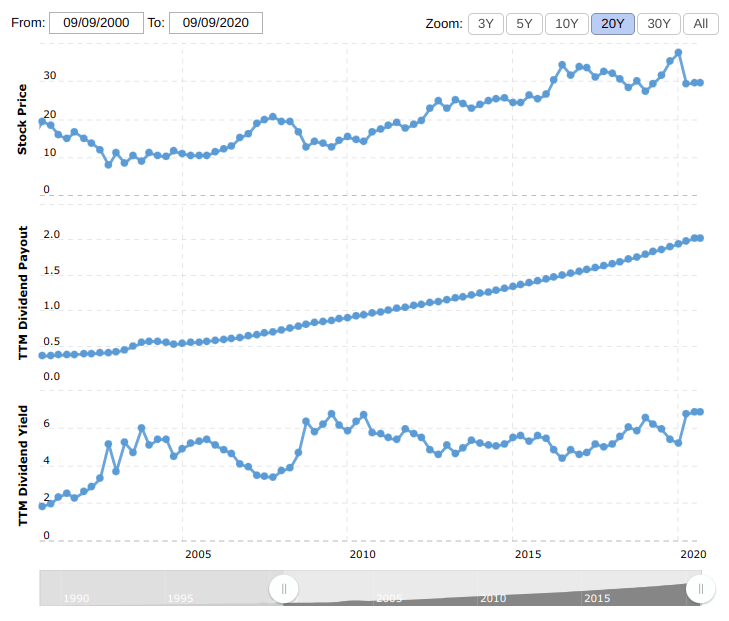

With stock markets trading near all-time highs, income investors are looking for undervalued Dividend Aristocrats that are still trading at favorable levels. At the moment, one of my favorite names in this undervalued dividend trading category is AT&T (NYSE:T), which has recently fallen to long-term lows below $30 per share. These declines have forced A&T's dividend yields above 7% but the stock's stable dividend payout ratio (65.06%) suggests that T-shares can be viewed as a preferred risk-reward opportunity for income investors. Within this context, our analysis strategies have flashed additional trading signals that indicate rising potential for a near-term trend bottom. For these reasons, we argue that income investors might benefit from the stock's long term historical tendencies as long as share price levels indicate limits in downside potential that favor a bullish stance on AT&T.

Source: Macrotrends

As one of the market's most reliable long-term dividend raisers, AT&T provides a $2.08 annual payout and the company is one of the few that has maintained multi-decade growth in its dividend payments. With interest rates expected to hold at historic lows for an extended period of time, we think income investors might consider the stability of a 7.14% dividend yield to be a blessing in what could be a very difficult market environment over the next several quarters.