Summary

- AT&T is incredibly different from General Electric despite comparisons made, thanks to the company's strong financial position.

- AT&T can comfortably handle its debt due over the next five years, generating double-digit shareholder rewards.

- We recommend investing in AT&T for the long run.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

AT&T (NYSE:T) is one of the three large telecommunication companies in the United States. Yet hardly a week goes past where investors don't read on Seeking Alpha about AT&T's debt load and how that foretells the disappearance of the company. A recent article on Seeking Alpha argued an upcoming recession would hurt its FCF so much its debt would overwhelm the company.

However, as we'll see throughout this article, AT&T's debt load is more than manageable for the company even in a recession.

AT&T Versus General Electric

The other article made the comparison to General Electric and the company's devastating collapse over the past decade.

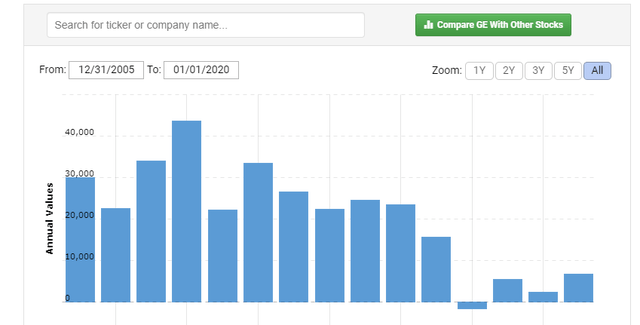

General Electric Free Cash Flow - Macro Trends

However, it's worth noting that the numbers are very different between the companies. General Electric peaked in the mid-2010s with roughly $20 billion in annual FCF and annual debt of more than $200 billion. The company had massively fluctuating FCF due to the volatile businesses that it operated in, including airlines and others.

Compare that to AT&T today. The company has nearly $30 billion in annual FCF, which has dropped to $25 billion for 2020, the worst year of COVID-19. At the same time, the company has roughly $154 billion in debt (although $17 billion in cash on hand). Still that gives the company a long-term debt to FCF ratio of roughly half that of General Electric.

Given that interest rates can fluctuate significantly, having that significant leftover cash is enormous. General Electric devastated its FCF to pay down its debt by selling assets. AT&T will arguably never need to worry about that. That doesn't count the fact that, as we'll discuss in this next session, AT&T is much better prepared to handle a recession.