Summary

- Altus Midstream has an impressive portfolio of assets, however, its core Alpine High business has all but disappeared.

- The company's overall market capitalization has been decimated since inception, dropping nearly 95%.

- The company's capital stack has minimal equity at this time. The company has strong JV positions in major pipelines.

- The company's largest risk is a decline in volume which could significantly hurt future DCF.

- At this time, we feel the company has significant potential and recommend investors invest <1% of their capital.

- This idea was discussed in more depth with members of my private investing community, The Energy Forum. Get started today »

Altus Midstream (NASDAQ:ALTM) has been devastated as a midstream company these past years. The company's share price has dropped 80% due to the COVID-19 collapse, and 94% since its IPO. The company is now worth 40% of the total amount raised in its IPO just a few years ago, an IPO that was for several times the company's market capitalization.

Altus Midstream - Altus Midstream

Altus Midstream History

Altus Midstream's history goes back to Alpine High, what was once a major "company maker" discovery with the potential to hold billions of barrels of oil. The company called it quits on the asset, due to the heavy natural gas component, and announced earlier this year that it was walking away from the asset.

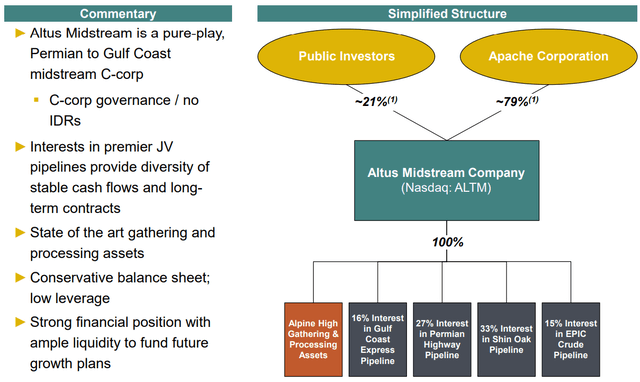

Altus Midstream Structure - Altus Midstream Investor Presentation

However, to develop the assets and build the required midstream infrastructure, Apache Corporation (NASDAQ:APA) set up Altus Midstream. Since then, the company's value has collapsed, with more than $3 billion in Apache Corporation's shareholding value lost, and nearly $1 billion lost to company investors.

Right now, the company's asset base is split across Alpine High, and the company's ownership in 4 major Permian Basin pipelines. The bulk of the article will focus on the company's ownership in these pipelines.