Summary

- J.C. Penney filed Bankruptcy with $1.4 Billion in Unencumbered Real Estate and $2.1 Billion in Inventory (at cost) and over $500 Million in cash?

- As of August 20, 2020 J.C. Penney has $1.48 Billion Dollars in cash after reporting in May they would be out of cash in June/July.

- A Motion to appoint an Official Equity Committee was filed on August 19th making the case that the equity is worth between $869 Million and $2.522 Billion Dollars.

- J.C. Penney's online business and credit card royalty revenue are collectively worth at least $3 Billion without the retail business or real estate.

- All J.C. Penney shareholders should buy unsecured bonds as a hedge as they are 1 cents on dollar (or less) and are higher in priority than the common stock.

This is my first article on J.C. Penney (OTCPK:JCPNQ) the historic retailer that filed Bankruptcy on May 15, 2020 with $500 Million dollars in cash, and $1.4 Billion dollars in unencumbered real estate.

I have over 20 years experience consulting in large complex Bankruptcy cases for Law firms, large creditors and Debtors. This is the strangest case I have ever seen.

This article will make the case that J.C. Penney is not "Hopelessly insolvent" and in fact has plenty of money left for unsecured creditors and shareholders if the right actions are taken and the right plan is implemented.

It's interesting to note, the debtor stressed two main points at the hearing for approval of the Debtor in Possession Loan in May 2020:

A. They predicted that unless they received a $450 Million dollar DIP Loan, they would run out of money in late June/July.

B. The Bankruptcy needed to move fast in order to keep the support of the 1st Lien holders.

From the beginning of the Bankruptcy, the projections made by the debtors advisors were very pessimistic, which was understandable due to the shut down of all of their stores during the quarantine. However, 300 stores opened sooner than expected, so the revenue projections which were based on a total shut down for many more months, were off by a long shot.

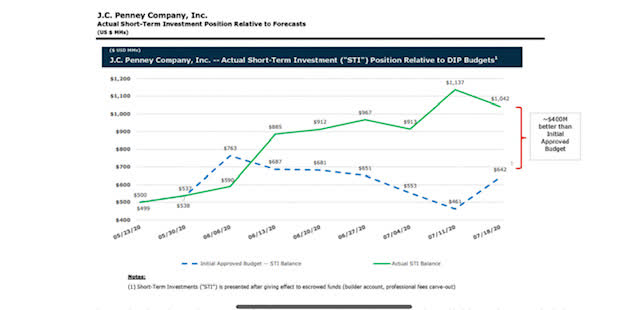

As shown in the chart below (Doc 1268) as of July 18th, 2020 their total available cash exceeded the June 4th projections by approximately $400 Million dollars (and exceeded the the projections in the interim cash flow projections by over $500 Million dollars)

This large increase in revenue gave shareholders a reason to celebrate as the Current Restructuring Support Agreement, wipes them about but was based on much lower revenue numbers.

However, after failing to run out of cash in June or July as they predicted, the Debtors' advisors predicted a liquidity crisis would now happen sometime in mid August, but instead they have amassed over $1.48 Billion in cash as of the writing of this article.

Because of the increasing revenue, J.C. Penney has a $450 Million dollar (DIP) Debtor in possession loan they have not had drawn on. Despite their earlier projections In May and June being off by hundreds of millions of dollars, they still have not adjusted their recovery projections for unsecured creditors and shareholders. This is further proof that an official equity committee needs to be appointed.