Summary

- AT&T has a long history of underperforming the overall market and its peers.

- I am pessimistic about the company's media ambitions.

- It is a good investment for income investors, but growth investors should stay away.

(Source: 123rf)

AT&T (T) is a well-known telecommunication and media company in America. It has more than $180 billion in annual revenue, making it the ninth-largest company in the Fortune 500 list. AT&T is also a beloved company among income investors because of its 6.92% dividend yield that is backed by a 57% payout ratio.

AT&T is also a cheap company if you look at the common metrics. It has a forward P/E ratio of ~9, which is lower than that of its peer companies. Verizon (VZ), Comcast (CMCSA), and T-Mobile (TMUS) have forward P/E ratios of ~12, ~16, and ~62, respectively.

This cheap valuation is mostly because of AT&T’s large debt burden of about $153 billion. This makes it the most indebted company in the United States. Still, with interest rates at historic lows and the Fed constantly buying corporate debt, I think this is not the primary reason.

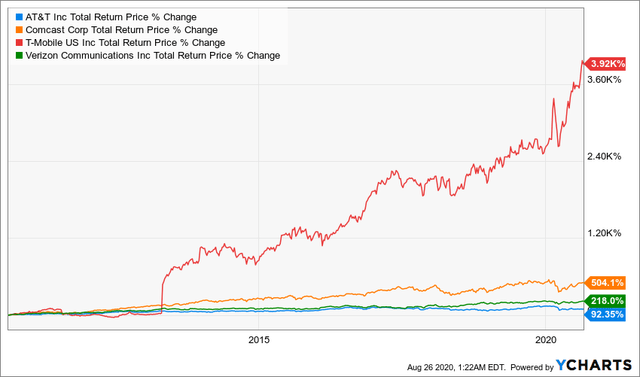

AT&T’s long track record of underperformance is the key reason why the company’s shares have lagged behind those of its key peers. First, as shown below, the company’s total return in the past ten years has been ~92%. That pales in comparison to what its peer companies have performed. This trend is seen in most periods that you look at. For example, YTD, AT&T shares have dropped by more than 23%, while Verizon (VZ) and Comcast (CMCSA) have dropped by ~3.22% and ~3.47%. T-Mobile shares have gained by ~47%, mostly because of its merger with Sprint.

AT&T’s underperformance is seen in most meaningful metrics. It has a poor history of acquisitions and lower margins. For example, the company has a gross margin of ~56%, while Verizon, Comcast, and T-Mobile have margins of ~61%, ~71%, and ~61%, respectively. The same is true when you look at the profit margin. AT&T has a net profit margin of 30.50%, while Verizon and Comcast have margins of ~15% and ~12%, respectively. T-Mobile has a lower margin of ~0.62%.