Summary

- Exxon Mobil's 2Q 2020 results were devastating, and the company has recently been punished further by being removed from the Dow.

- However, despite this, the company has significant potential to generate impressive long-term shareholder rewards as it focuses on low cost production.

- The company does have risk from lower oil prices. However, long-term low oil prices are incredibly unlikely in our view.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Exxon Mobil (NYSE:XOM) was the world's largest company in 2013. Now, it's been removed from the Dow Jones in what's been widely called a sign of the changing times, with its market capitalization at roughly 9% of the current largest company in the world, Apple (NASDAQ:AAPL). In fact, Exxon Mobil was at 40% of its mid-2014 share price before the collapse started.

However, despite this decline, Exxon Mobil actually has significant potential to generate long-term shareholder rewards in a market that's historically expensive.

Exxon Mobil Asset Overview

Exxon Mobil has an incredible portfolio of assets and, arguably, the most diverse portfolio of assets in the market.

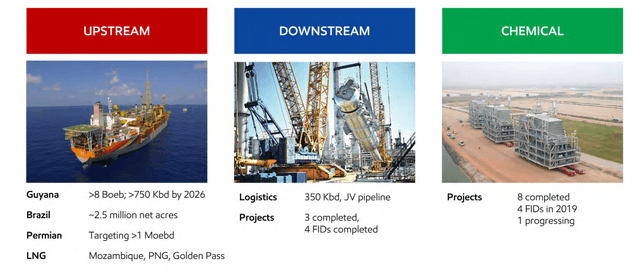

Exxon Mobil Asset Portfolio - ExxonMobil Investor Presentation

Exxon Mobil's upstream resource portfolio has been expanding dramatically, which we'll discuss in more detail later. The company has arguably the most diversified and exciting portfolio of upstream oil assets across the world and has found a number of exciting growth opportunities. The company is rapidly expanding its assets in Brazil and its LNG assets worldwide.

Additionally, the company is rapidly expanding production and resources in both the Permian Basin and Guyana. In the Permian Basin, the company is targeting >1 million barrels/day of production at a $15/barrel breakeven. In Guyana, the company is targeting >750 thousand barrels/day by 2026 with more than 8 billion barrels of resources.

Downstream and Chemical, the company has continued to progress substantial projects, maximizing its margins across the value chain. That helps minimize the company's risk and maximize its earnings.