Summary

- Digital revenue is carrying the company's growth.

- The company has a strong footprint in the podcasting realm.

- Better balance sheet after Chapter 11.

- FCC licenses are a smaller portion of the company's assets compared to peers.

It's easy to look at legacy broadcast groups and write them off. With the rapid growth of streaming giants like Netflix (NFLX) and Spotify (SPOT), traditional names in the media space are somewhat out of favor. This presents potential opportunity if you can find the right names. Though many of these traditional broadcast groups will ultimately fail, some will adapt and survive. As my small readership is already aware, I've looked at a many of these companies and have taken a flier on a couple of them. iHeartMedia (IHRT) is not one that I anticipated liking. But after a look under the hood, the stock now has my interest despite considerable mounting risks.

You can't look at broadcasting names as an investment idea without understanding the significant disruption happening in the space. Many of the broadcasting names have significant debt obligations coupled with costly infrastructure that is becoming less necessary as time goes on. COVID-19 has been dubbed the "great accelerator" by some. Things that we may have thought would take 5 to 10 years to happen are now going to happen much faster. In the case of media companies, I believe this to be vert true. Just look at what we've seen happen in the subscription TV business the last several months.

Consumers have been canceling pay-TV plans at record numbers this year, even though the coronavirus has kept them home and, presumably, in front of their TVs. The pandemic accelerated the cord-cutting trend by suspending live sports and putting households on tighter budgets, industry analysts said. The virus also paused production of new shows — so entertainment offerings became stale — and forced bars, hotels, and other businesses to cancel their TV plans, too.

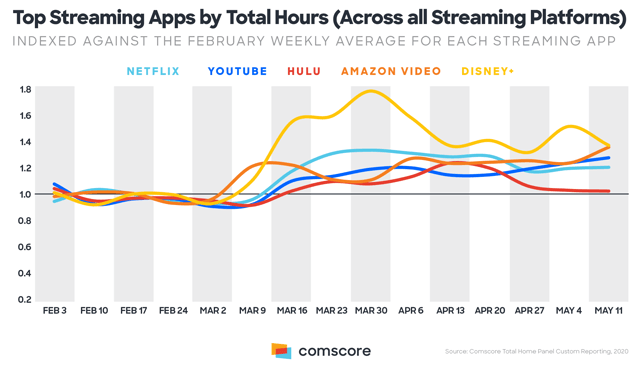

The virus has had a sizeable impact on the media landscape. While consumers are cutting the cord at a more ferocious pace, streaming on-demand properties have seen surges in usage.

Consumers are speaking loud and clear; they want content when they want it. Video isn't the only thing consumers want on demand. Audio is very much in that same boat. The Recording Industry Association of America provides some great insight into consumer behavior in the music industry. The market is rapidly moving away from a buy and own preference to a subscriber preference.

Consumers are speaking loud and clear; they want content when they want it. Video isn't the only thing consumers want on demand. Audio is very much in that same boat. The Recording Industry Association of America provides some great insight into consumer behavior in the music industry. The market is rapidly moving away from a buy and own preference to a subscriber preference.