Summary

- VITL shares soar 63% in first day of trading on the Nasdaq.

- Consumers are turning to more ethical and sustainable choices for protein and dairy products, a relatively small market.

- Few other comparable companies have been able to scale products like VITL.

- Editor's note: Seeking Alpha is proud to welcome Nicole Kozhukhov as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Investment Thesis

Vital Farms (VITL) is poised for robust and continuous growth as the sustainable food industry continues to grow. Consumers are shifting awareness toward ethical practices and their diets toward sustainably grown food. With raising capital via the IPO, Vital Farms has access to more dry powder that would allow them to improve their scaling. Currently, only 2% of American Households currently buy Vital Farms, which gives the company room to obtain market share in relatively small industry.

Company Overview

Vital Farms is an Austin, Texas based ethical food company that provides pasture-raised eggs, butter, and ghee. It is the #1 brand for pasture-raised eggs, focusing on humane practices for hens and trying to elevate the industry's standards for ethics. The company emphasizes conscious capitalism, using a network of 200 family farms to distribute products to 13,000+ grocery stores including Kroger and Whole Foods. In 2018, Pitchbook valued the company at $136 million. After its IPO, its market cap was $1.3 billion at the close-an 855% increase, respectively after 2 years.

Current & Recent Financials

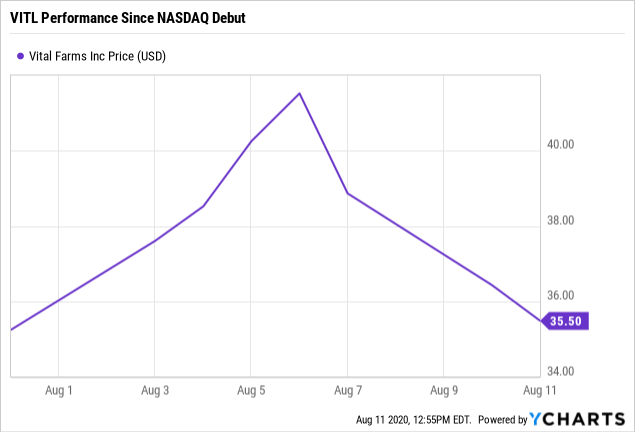

As the chart below suggests, Vital Farms share price has already peaked within days of trading. However, with IPO's and especially during this environment, I am not worried about it. Shares priced above the projected range ($15-$17) at $22, and have stayed above the initial pricing since the company went public.

Data by YCharts

Data by YChartsVital Farms' Sales were $155 million for the year ended March 31, 2020. Vital Farms raised $125 million through its IPO, offering 7.8 million shares. In the current environment where companies are scrambling for liquidity, Vital Farms is in a good position with ample dry powder. Egg Central, which is the processing plant for all of Vital Farms' eggs, is currently expanding. I believe this expansion will increase the company's reach and processing speed-which should have nothing but positive impacts on future revenue.