Summary

- Parsley Energy is in a good position to weather the debt storm overtaking many shale players.

- They generate free cash at $35 bbl WTI.

- Shares have rallied as momentum has come into the energy sector over the last month.

- We like Parsley at the current level and see it going higher as oil prices advance.

- Looking for a portfolio of ideas like this one? Members of The Daily Drilling Report get exclusive access to our model portfolio. Get started today »

Introduction

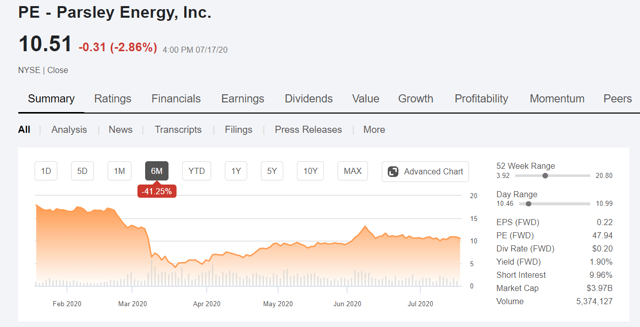

Shares of Parsley Energy (PE) suffered over the first part of the year thanks initially to an ill-timed acquisition, Jagged Peak, in October of last year. And, of course, the virtual collapse of industry fundamentals due to the oil price war and the COVID-19 outbreak, making the Jagged Peak deal look even worse in hindsight.

In this article we will review this company within our core thesis for shale survivors.

- Liquidity - As a combination of cash and credit, can they last more than a quarter or two before hitting a wall?

- Good rock - Is their acreage in what we know to be the best areas for optimal decline and high IPs?

- Critical mass - Are they big enough to compete?

- Cash flow - Are their core costs covered with cash flow?

- Low cost producer - What is their low cost per barrel?

- Logistics - Can they optimize water and sand logistics to keep costs down?

- Management - Does the past performance of senior management suggest they have the vision to guide the company going forward?

Note - This article appeared in the Daily Drilling Report in mid July.