Summary

- Halliburton is adjusting its business model to that of a high technology service provider.

- The future the company sees is smaller, but more efficient and profitable.

- We think the company makes a compelling argument and expect further growth in a rising oil price environment.

- Looking for a portfolio of ideas like this one? Members of The Daily Drilling Report get exclusive access to our model portfolio. Get started today »

Introduction

In my last article on Halliburton (HAL), where I implored the readers to scoop up Hally with both hands if they had any interest in the oilfield space at all as an investment vehicle, I identified some key elements in a potential recovery, and made my pitch.

"Halliburton: All-time Lows Flash A Strong Buy Signal"

- Cost-cutting leading to profitability in a down market

- Solvency - cash and credit lines to see better commodity pricing

This makes the stock at current prices an outstanding buy for investors looking to average down their cost basis or make a bet on an improving market. I am adding at these levels."

The share price was ~$5 a share when this article came out (source).

Well, the company delivered on the cost-cutting front and managed to generate a surprising amount of free cash in the second quarter. As a reward Bank of America analyst Chase Mulvehill upped his price target to $18. We think this is baked in and further gains could be seen as we close out the year. In this article we will review the shale recovery thesis for generating continued gains in this stock.

Note - this article appeared in the Daily Drilling Report on July 23 when the stock was at $14.80. At today's price, members have had the opportunity to earn 12% on an investment in three weeks.

The thesis for Halliburton

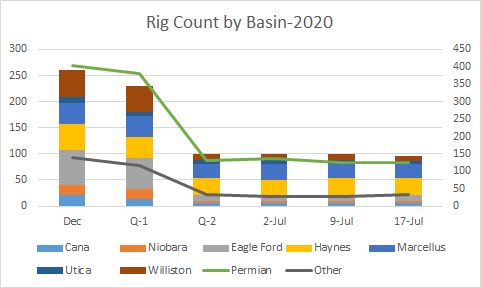

I think we can agree - shale has shrunk. In order to maintain its formerly prodigious output at ~9 mm BOEPD, it required the better part of a 1000 rigs turning to the right. We are far, far from the figure today, and after 18 consecutive weeks, we still haven't hit bottom on the rig count. Today a paltry 253 rigs are searching for oil and gas in domestic North American shale plays.

Baker Hughes

Here's the thing. It's going to start getting better and that spells good news for Hally. Now let's be clear neither I, nor Halliburton, is calling for a "mini-boom;" the takeaway here is the bottom is near in terms of drilling activity. Hally's CEO Jeff Miller comments in the call: