Summary

- Gas and NGL’s enabled positive operating cash flows in Q2.

- Production ramp up and higher realized prices to generate healthy free cash flows going forward.

- Strong liquidity and low debt ensure that dividends will be maintained.

- ConocoPhillips’ advantage is that it benefits from a stable and not just a rising oil price environment.

- Upstream focus in a steady energy price environment to elicit a relative valuation premium.

Gas and NGL's enabled positive operating cash flows in Q2

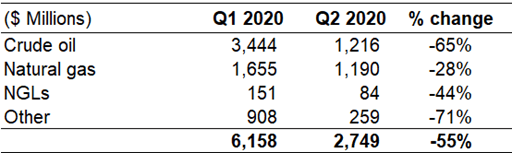

Q2 2020 was challenging for ConocoPhillips (COP) to say the least. During a historical crash in crude oil prices, adjusted loss was $994 million as against $486 million and $1.14 billion adjusted earnings in Q1 2020 and Q1 2019 respectively. During Q2 2020, COP faced the double whammy of nearly 50% decline in average realized crude oil price and 24% lower production. Executed production curtailments were at 225 MBOED. Despite this, COP was able to generate positive operating cash flows of $157 million. This is because Natural gas and NGL's combined contributed 46% to Q2 revenue and portrayed just 29% QoQ decline vs 65% dip in crude oil revenue (Chart 1). Production and realized price of natural gas just decreased by 15% and 25% respectively. This shows the resilience of COP's revenue stream and relatively low dependency on crude oil. This is positive because Natural gas is less volatile in the short-term and thus minimizes wild swings in profitability that we see in other energy players.

Chart 1 - Sales and Other Operating Revenues by Product

Source: COP Quarterly Filings

Production ramp up and higher realized prices to generate healthy free cash flows going forward

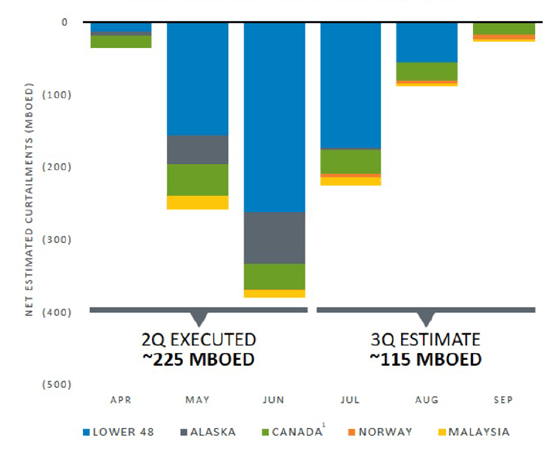

During Q2 2020 COP executed production curtailments of 225 MBOED or approx. 17%. Ramp up has started in July with production expected to be fully restored by September (see Chart 2). Ramp up from COP's unconventional basins (i.e. Permian, Eagle Ford and Bakken) are expected to add 140 MBOED to production while Alaska ramp up adds another 40 MBOED. As a matter of fact, Alaska production was fully restored during July.

Chart 2 - 2020 Production Curtailments

Source: ConocoPhillips Q2 2020 Conference Call

Crude oil prices are hovering around the $40/bbl level. This is extremely crucial because in the medium-term, COP can sustain capex and maintain production at under $40/bbl crude oil. Q1 capex declined by $773 million. In our view, this is only temporary and emanated from stopping fracking activities. We think that in the improved price environment, capex though lower, will gradually normalize. COP is likely to normalize capex to the point that maintains production at economic levels. The company has demonstrated significant flexibility in doing that. During Q3 onward, COP is expected to benefit from the dual effect of surge in production and higher realized prices. This means that in the current situation, we project that COP will be able to generate free cash flows of $400-500 million in Q3 and $800-900 million in Q4 2020.