Summary

- Cinemark can make a profit at 20% to 30% occupancy rates.

- Cinemark also has more financial flexibility in comparison to AMC, which will help it to avoid a liquidity crisis in the near term.

- We hold a long position in Cinemark, which we use as a hedge against our short position in AMC.

It will take a couple of years for Cinemark (CNK) to return to its 2019 profitability levels. The biggest downside of the company is that it's exposed to the United States and Latin American markets, which are currently the epicenters of COVID-19. As its theaters continue to be closed to this day, Cinemark will continue to burn cash on rent and other maintenance-related expenses and will not be able to generate a substantial amount of revenue to cover those expenses. All of this makes Cinemark a high-risk investment.

However, in normal times, Cinemark has been profitable at 20% to 30% occupancy rates. If it manages to reopen its theaters later in August, then it doesn't matter that those theaters will not be fully occupied since the company will be able to make money from low occupancy rates anyway. By not being overleveraged in comparison to its peer AMC (AMC) and having more than $600 million in liquidity, we believe that Cinemark has enough resources to survive the pandemic and recover once its theaters are reopened later this year.

Currently, we hold a short position in AMC and believe that there's a high chance that the company will file for bankruptcy if it fails to service its debt. To hedge our position, we decided to acquire shares of Cinemark, since the company has a better balance sheet and better chances for a recovery in a post-pandemic world.

Movie Business in the Age of COVID-19

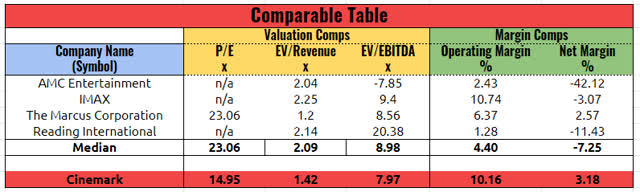

In February, when COVID-19 was under the control inside the United States, Cinemark was able to grow its revenues by 5% Y/Y, while its adjusted EBITDA was up 16% Y/Y. However, the spread of the virus in March quickly disrupted the company's operations and Cinemark reported a substantial decline in earnings in the first three months of the year. Its revenues in Q1 were down 23.9% Y/Y to $543.62 million, while its GAAP EPS of -$0.51 was below the street estimates by $0.34. The total net loss was $59.6 million against a net income of $32.7 million a year ago. Because of such a poor performance, Cinemark stock lost more than 50% of its value since the beginning of the year. While the company trades at EV/EBITDA of 7.97x, below the industry's median, it's impossible to find out the fair value of Cinemark and its peers using the comparable analysis in the current environment.

Source: Capital IQ

However, the performance in February shows that in normal times Cinemark is a cash-generating machine. Its 345 theaters across 42 US states were able to fully fund the interest expenses and dividends at an occupancy rate of around 20% to 30%. Therefore, if social distancing measures are implemented inside its theaters, then Cinemark will still have a high chance to make a profit.