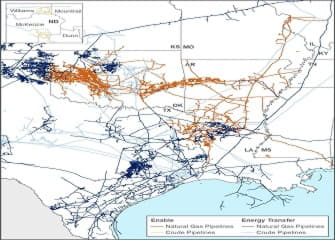

Complementary Asset Base Drives Value Across Footprint – Creates Contiguous Asset Footprint

DALLAS & OKLAHOMA CITY--(BUSINESS WIRE)--Energy Transfer LP (NYSE: ET) and Enable Midstream Partners, LP (NYSE: ENBL) today announced that they have entered into a definitive merger agreement whereby Energy Transfer will acquire Enable in an all-equity transaction valued at approximately $7.2 billion. Under the terms of the agreement, Enable common unitholders will receive 0.8595 ET common units for each Enable common unit, an exchange ratio that represents an at-the-market transaction, based on the 10-day volume-weighted average price of ET and Enable common units on February 12, 2021. In addition, each outstanding Enable Series A preferred unit will be exchanged for 0.0265 Series G preferred units of Energy Transfer. The transaction will include a $10 million cash payment for Enable’s general partner.

Positive Financial Impact

The transaction furthers Energy Transfer’s deleveraging efforts as it is expected to be immediately accretive to free cash flow post-distributions, have a positive impact on credit metrics and add significant fee-based cash flows from fixed-fee contracts.

The all-equity nature of the transaction allows unitholders of both partnerships to participate in the value creation potential of the combined partnership.

Complementary Assets

Energy Transfer’s acquisition of Enable will increase Energy Transfer’s footprint across multiple regions and provide increased connectivity for Energy Transfer’s natural gas and NGL transportation businesses.

Energy Transfer will significantly strengthen its NGL infrastructure by adding natural gas gathering and processing assets in the Anadarko Basin in Oklahoma and integrate high-quality assets with Energy Transfer’s existing NGL transportation and fractionation assets on the U.S. Gulf Coast. The acquisition will also provide significant gas gathering and processing assets in the Arkoma basin across Oklahoma and Arkansas, as well as the Haynesville Shale in East Texas and North Louisiana.

Enable’s transportation and storage assets enhance Energy Transfer’s access to core markets with consistent sources of demand and bolster its portfolio of customers anchored by large, investment-grade customers with firm, long-term contracts. Energy Transfer will further enhance its connectivity to the global LNG market and the growing global demand for natural gas as the world transitions to cleaner power and fuel sources.

Synergies

The combination of Energy Transfer’s significant infrastructure with Enable’s complementary assets will allow the combined company to pursue additional commercial opportunities and achieve cost savings while enhancing Energy Transfer’s ability to serve customers.

Energy Transfer expects the combined company to generate more than $100 million of annual run-rate cost and efficiency synergies, excluding potential financial and commercial synergies. Potential commercial synergies include significant incremental earnings, which may result from integrating Enable’s Anadarko gathering and processing complex with Energy Transfer’s fractionation assets on the U.S. Gulf Coast.

Advisors

Citi and RBC Capital Markets acted as financial advisors to Energy Transfer and Latham & Watkins LLP acted as legal counsel. Goldman Sachs & Co. LLC acted as financial advisor to Enable and Vinson & Elkins LLP acted as legal counsel. Intrepid Partners, LLC acted as financial advisor and Richards, Layton & Finger, PA acted as legal counsel to Enable’s conflicts committee.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with a strategic footprint in all of the major domestic production basins. ET is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, NGL and refined product transportation and terminalling assets; NGL fractionation; and various acquisition and marketing assets. ET, through its ownership of Energy Transfer Operating, L.P., also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and 28.5 million common units of Sunoco LP (NYSE: SUN), and the general partner interests and 46.1 million common units of USA Compression Partners, LP (NYSE: USAC). For more information, visit the Energy Transfer LP website at https://www.energytransfer.com/.

About Enable

Enable (NYSE: ENBL) owns, operates and develops strategically located natural gas and crude oil infrastructure assets. Enable’s assets include approximately 14,000 miles of natural gas, crude oil, condensate and produced water gathering pipelines, approximately 2.6 Bcf/d of natural gas processing capacity, approximately 7,800 miles of interstate pipelines (including Southeast Supply Header, LLC of which Enable owns 50%), approximately 2,200 miles of intrastate pipelines and seven natural gas storage facilities comprising 84.5 billion cubic feet of storage capacity. For more information, visit https://www.enablemidstream.com/.