Summary

- Tesla is now a S&P 500 member, a watershed moment for one of the biggest stock market stories in our lifetimes.

- The question is - is inclusion vindication, or the last bullet left in a (very very successful) bull case?

- We talk with one of the longest-term and most notorious shorts, Mark Spiegel, about the state of the short case and where Tesla might go.

- No bonus points for guessing what Mark's view might be.

A podcast by Daniel Shvartsman and Akram's Razor

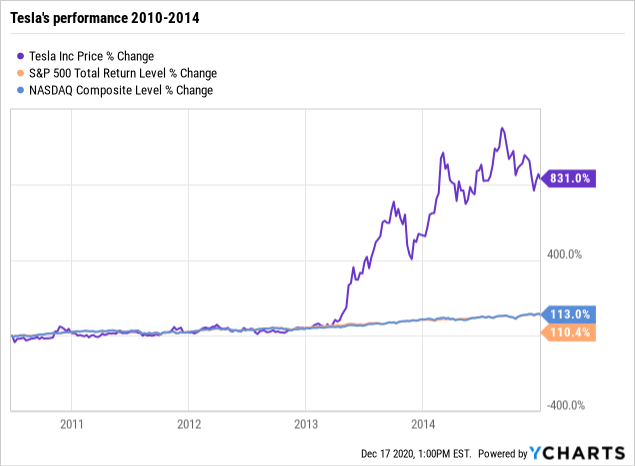

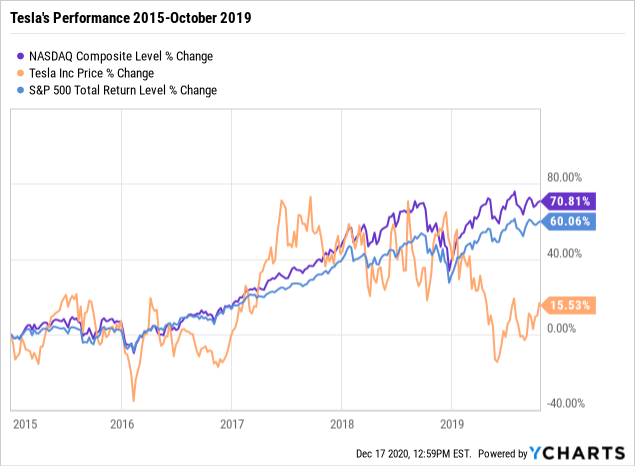

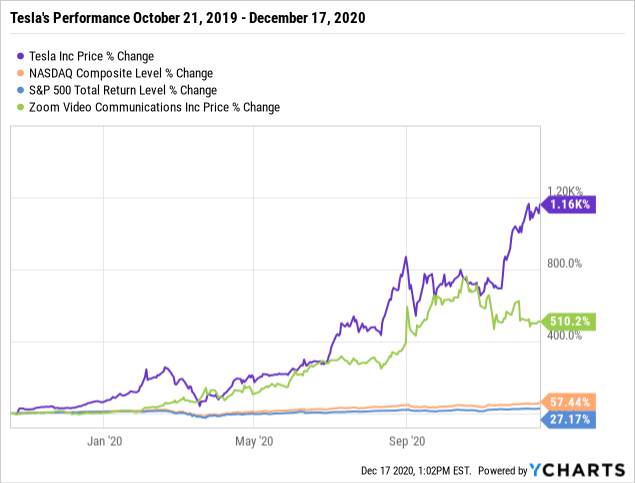

What is interesting about Tesla (TSLA) if you step back for a moment is that the company is likely to define this period in the market - define that as the bull market that ended in February or the bull market that restarted in March, or connect the two - but was unremarkable as an investment for long stretches of time. Let's break out some charts.

Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts Data by YCharts

Data by YChartsIt's possible you've seen charts like these. It's possible I've shared them. But it's still astounding. This has come as Tesla has attracted detractors throughout that run, and you can argue that they were more or less proven right through that second chart, even encompassing the famous $420 tweet period and its aftermath. And yet I suspect few of the shorts truly got to savor that period; and even more yet, if they did savor that period, the most recent run would have wiped any memory of that taste in their mouths.