Summary

- Exxon Mobil's recent rally likely isn't over based on improving oil and natural gas prices.

- A trader made a nearly $7.5 million options bet the stock rises over $50.

- The technical chart shows a very bullish double bottom pattern.

- Looking for more investing ideas like this one? Get them exclusively at Reading The Markets. Get started today »

Exxon Mobil (XOM) has been on a tear as oil and natural gas prices rise in hopes for a global reboot following the coronavirus pandemic. It has resulted in the price of oil rising to around $45, its highest price since March. This has resulted in traders betting that Exxon Mobil's good fortunes continue with the shares pushing above $50 by the middle of July and the shares' potential to gain more than 20% from its price of around $42.40 on December 8.

You can track all of my Seeking Alpha articles on this Google spreadsheet.

Estimates Not Rising - Yet

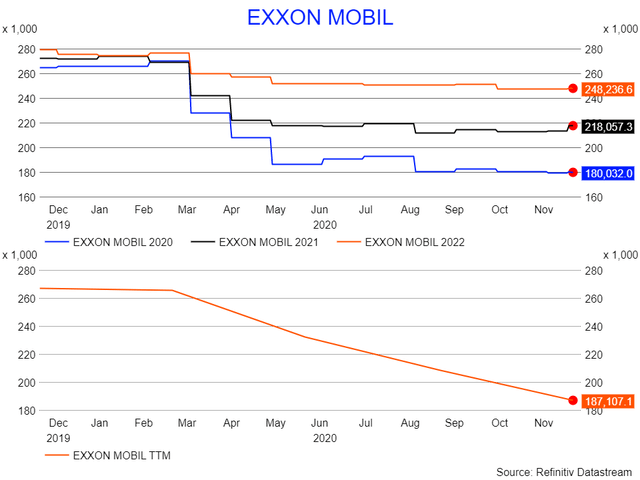

Despite rising oil and natural gas prices, analysts have yet to boost their revenue estimates for the company higher in a meaningful way. Currently, analysts forecast revenue to rise to around $218 billion in 2021 and $248 billion in 2022, from $180 billion this year. However, estimates for next year have only increased slightly; they stood at $213 billion in the middle of November.

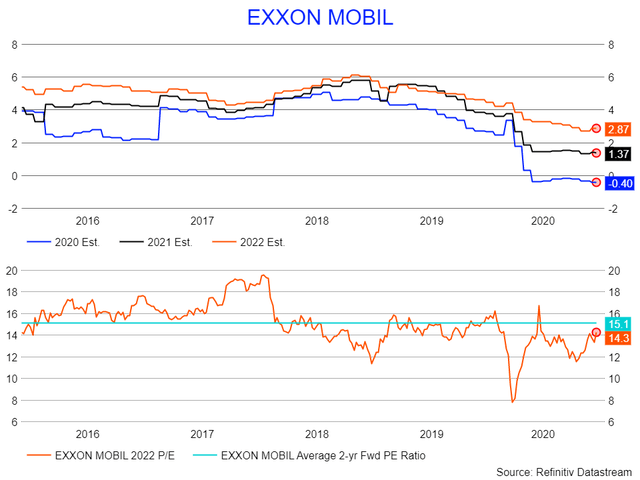

Meanwhile, earnings for the company have remained relatively unchanged as well. Now expected to rise to around $1.37 per share next year and $2.87 in 2022 from a loss of $0.40 in 2020. Those estimates are up just slightly, from $1.35 and $2.70, respectively, in the middle of November. Meanwhile, the stock is still trading for around 14.3 times 2022 earnings estimates, below the historical average of about 15.1 over the past years.

The lack of revenue and earnings upgrades suggests that analysts may be dragging their feet to increase estimates. They are either waiting to see if the recent move higher in oil and natural gas is here to stay, or they are likely to increase those estimates soon. Natural gas prices have increased to $2.40 from around $1.40 in the middle of July.