Summary

- AT&T has an impressive portfolio of assets, but the company continues to suffer from investor perception of financial risk.

- The company can manage its debt load, and has only outperformed its original COVID-19 expectations.

- We expect the company to generate substantial and long-term shareholder rewards.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

AT&T (NYSE: T) is, in our opinion, one of the most undervalued large capitalization companies. Despite the company's history of struggling to provide substantial shareholder rewards, investors continue to view the company as a source of enormous opportunity. However, the company continues to make the news as it tries to sell assets for fire-sale prices.

AT&T and Investor Perception

AT&T's share price has continued to suffer from a fundamental perception that it's a company in a difficult position. The company does have a substantial debt load from acquisitions of DirecTV and TimeWarner, in fact it has more debt than any other company in the United States. However, despite this, the company's cash flow is more than enough to cover this debt.

Due to investor perception though, the company has felt the strong urge to consistently reduce its debt. As a result, the company has consistently looked into selling assets to improve its debt load. The company has proposed selling all sorts of assets, most recently its massive DirecTV acquisition, at less than 25% of its purchase price.

This investor presentation has continued to plague the company and it's something worth paying close attention to.

AT&T's True Business Priorities

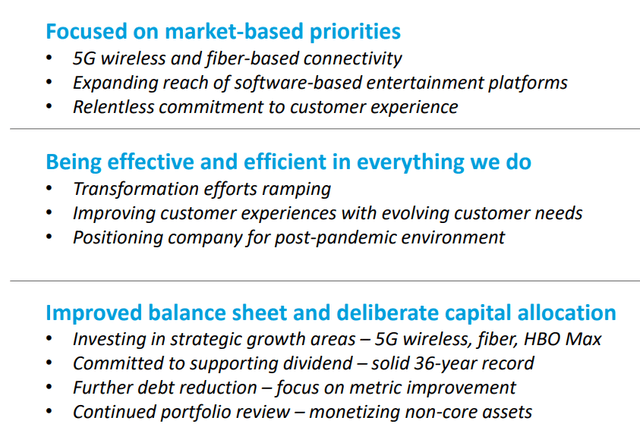

However, AT&T continues to focus on its true business priorities and to support its long-term growth.

AT&T True Business Priorities - AT&T Investor Presentation

AT&T is continuing to focus on its key businesses, specifically 5G wireless and fiber-based connectivity. Fiber-based connectivity, or the company's home internet service, is an aspect of the company's cash flow that we're particularly excited about long-term. We can see the company growing its fiber business for its long-term potential.