Summary

- There is a $150 billion elephant in the room when AT&T stock is mentioned.

- There are many columns on AT&T but only some mention the debt.

- A deep look at the debt is provided, with the big story being the moves made to reduce the coupon rate and reduce obligations.

- A big cash position and reduced net debt to EBITDA suggests the credit ratings may be increased in coming quarters.

- Expect a dividend raise, AT&T can afford it.

- This idea was discussed in more depth with members of my private investing community, BAD BEAT Investing. Get started today »

Prepared by Tara of team BAD BEAT Investing

AT&T (NYSE:T) stock really has not done much since it released its anticipated Q3 earnings report. We have said that there is a lot of madness around AT&T. It is true. We will reiterate, simply go to the comments section of any of the many T articles on Seeking Alpha, and you will see the madness. Supreme bulls. Forever bears. Arguments over WarnerMedia. Discussions over management quality. The list goes on and on. There are very few stocks that trade with the boring action of AT&T that draw such bull versus bear battles. We continue to see immense challenges for AT&T's operations for the next few months. But if we set the COVID-19 impact aside for a moment, the third quarter was pretty much what we had expected and was decent. One thing that was not discussed much was the debt. The debt is really the 'elephant in the room' as it were. The bears always used to hone in on this, until steps were taken to start addressing it. But the debt remains very high. Over at BAD BEAT Investing, we had a lively roundtable with our staff over this issue. It turns out that most retail investors have no clue about the debt other than what they read. In this column, we shine some light on this important issue.

The debt rating

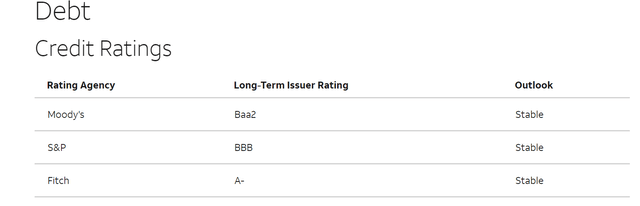

The first thing you should be aware of is the investment grade debt rating that AT&T boasts.

Source: AT&T investor relations debt detail

So, what does this mean? Well, these are ratings on the debt that the company has. There are three agencies that provide credit ratings: Moody's, Standard & Poor's (S&P), and Fitch Ratings. Essentially, each of these agencies aims to provide a rating system to help investors determine the risk associated with investing in a specific company, investing instrument, or market. Ratings can be assigned to short- and long-term obligations.

Bottom line? The ratings assess a company's ability to pay debts. The ratings somewhat measure the company's ability and willingness to repay debt. Now, AT&T doesn't have the best ratings.

| Moody's | Fitch | Standard & Poor's | Total Grade | Assumed Risk |

| Aaa | AAA | AAA | Investment | Lowest Risk |

| Aa | AA | AA | Investment | Low Risk |

| A | A, A- | A | Investment | Low Risk |

| Baa | BBB | BBB | Investment | Medium Risk |

| Ba, B | BB. B | BB, B | Junk | High Risk |

| Caa/Ca/C | CCC, CC, C | CCC/CC/C | Junk | Highest Risk |

| C | RD,D | D | Junk | In Default |

Source: Author generated Table based on rating's agencies information

As you can see, AT&T's debt rating is not top tier. However, it is all investment grade, either low or medium risk. As debt gets paid down, and or operations/cash flows improve, ratings can and will improve. But the question many times we are asked is what makes up this debt?