Summary

- Exxon Mobil has announced they're proceeding with the next round of their Guyana discovery.

- The company has significant potential from both Guyana and the Permian Basin along with other discoveries.

- With the potential for a significant FCF yield, the company is a valuable investment.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

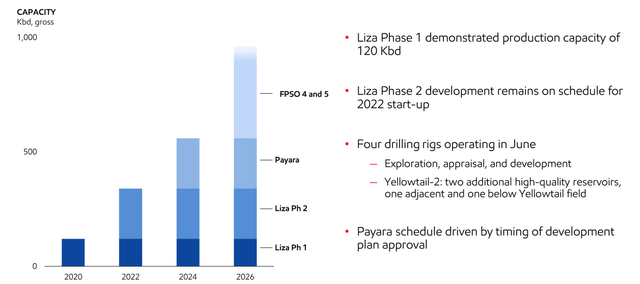

Exxon Mobil (NYSE: XOM) is now the third largest publicly traded oil company in the world, behind Chevron (NYSE: CVX) and Saudi Aramco (ARMCO). The company has recently announced that it's proceeding on its Payara offshore development, with production expected to begin in 2024 at 220 thousand barrels/day.

That'll push total Guyana production towards 560 thousand barrels/day. As we'll see throughout this article, the continued progression of the company's projects in these difficult times highlights how undervalued the company is.

Exxon Mobil Guyana

Exxon Mobil is progressing forward rapidly with Guyana.

Exxon Mobil Guyana Progression - Exxon Mobil Investor Presentation

Exxon Mobil recently started up Liza Phase 1 with its 45% stake at a net $35/barrel cost. It expanded to Liza Phase 2 with 220 thousand barrels/day at $25/barrel cost. Now, the company is starting up Payara with 220 thousand barrels/day in production at $25/barrel breakeven. Brent crude trades at nearly $43/barrel.