Summary

- Q3-2020 shows 97% of its tenants are now open and operating.

- 10 out of its 1,386 tenants have filed for bankruptcy. This is a very low bankruptcy rate.

- This pure play retail REIT continues to earn cash flow in the middle of a pandemic.

Whitestone REIT (NYSE:WSR) is a retail pure play REIT focused on acquiring, developing, and managing Community Center Properties. It has 53 properties located in six of the top ten fastest growing markets (by population growth) in the United States.

Compared to other retail REITs, Whitestone REIT continues to manage its downside well. Its operating strategy has proven to be resilient even during today's pandemic. The stock price is now trading closer to its 52-week low, and this makes it a good buying opportunity.

Whitestone REIT's Financials Continue to be Sound

Whitestone REIT has gone to great lengths to protect its downside. It has done this by helping its tenants adapt by:

- Assisting its restaurant tenants to increase their takeout business

- Expanding the outdoor spaces to help with social distancing

- Implementing digital signing

These efforts have led to 97% of its tenants now open and operating. An increase from 81% in Q2-2020. Also, as of Sept. 30, 2020, there have only been 10 out of 1,386 tenants who have filed for bankruptcy.

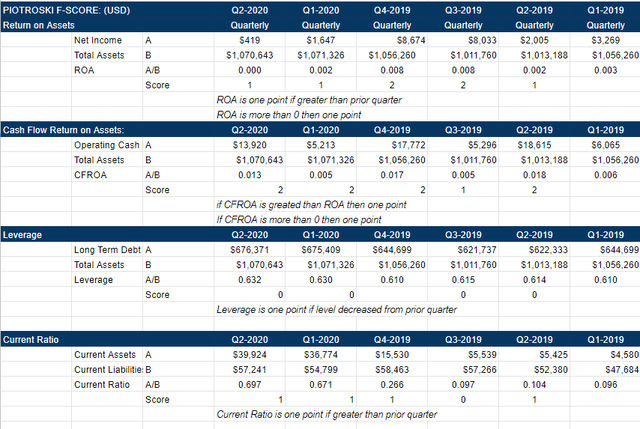

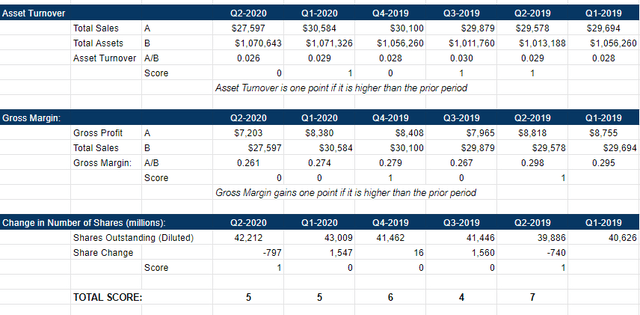

Even during the worse of the pandemic when businesses were forced to shut down, Whitestone REIT continued to produce a profit. In looking at its F Score where it measures its financial strength, the company scores in the middle of the range:

(Source: Whitestone REIT Financials)

As you can tell from the above, even before the pandemic, its F score remained in the five to six range. This shows the company's financial position has stayed largely the same. Its leverage had increased slightly, but the REIT continued to collect cash and keep its operations humming along.