Summary

- Compelling valuation opens the door for a once-in-an-economic-cycle entry point.

- Strong credit profile should limit share price downside.

- Its Texas footprint has decades of growth to come, setting the stage for continued success.

Investment Thesis

Headquartered in Abilene, Texas, First Financial Bankshares (FFIN) just crossed the ever important $10 billion threshold. The company operates multiple banking regions with its 78 locations and 9 trust company offices. The FFIN footprint stretches from Hereford, Texas, throughout the Panhandle to Orange, located in southeast Texas.

Bank investors need to beware of the Durbin amendment and what happens once a bank crosses that dreaded $10 billion line. The Durbin amendment is part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which limits a few key noninterest income segments.

More specifically, interchange fees collected by the bank from debit transactions take the biggest hit. Since FFIN just crossed the $10 billion threshold in the second quarter, starting next year, management will need to start complying with yearly examinations from the Consumer Financial Protection Bureau. When its all said and done, FFIN will likely need to find a way to fill this $10 million gap in fee income (i.e., the loss of interchange fees).

That being said, FFIN is one of the most profitable banks in the country, courtesy of an economically strong Texas footprint, conservative credit culture, large core deposit base and efficient cost structure. The company has also been a highly disciplined acquirer of community banks. If you are investing for the long term, rather than trading in today's choppy markets, I believe current valuation is a once-in-a-cycle opportunity.

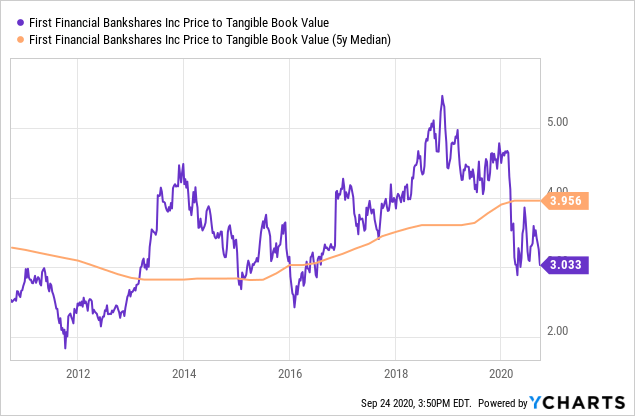

Data by YCharts

Data by YChartsAs one can see from the chart above, the last time the shares had this level of a discounted on valuation was in 2012. While it lasted about a year, I would recommend potential long-term shareholders to start averaging in today.