Summary

- Tenet Healthcare is an undervalued healthcare stock trading with significant upside.

- Recent earnings reported a loss on revenue, but an EPS beat by $1.97.

- THC has shown strong growth in net profit, earnings, and earnings per share.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Risk comes from not knowing what you’re doing. – Warren Buffett

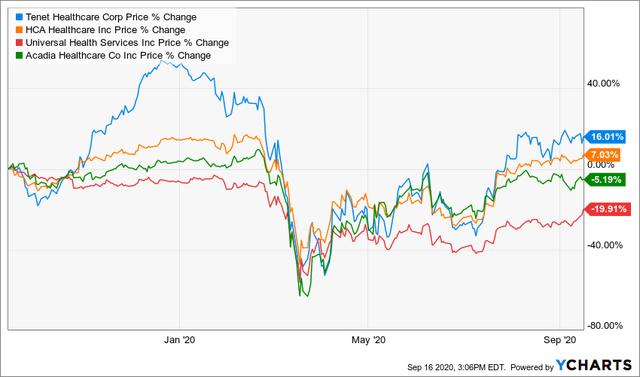

Hospitals and healthcare have never been as important to society as they are now in the midst of a pandemic. Many hospitals, however, have suffered financially, and have had their resources used to their limits. Despite that, there is a diversified healthcare company based in Dallas, Texas, that has not only shown how important it is to a functioning society, but also shown how it has adapted in the face of long odds. This is a stock trading at a significant discount with a strong upside that is more likely to surge in the near future. That company would be Tenet Healthcare (THC). COVID-19 has economically affected all industries across the globe, and hospitals have been no exception. However, because of Tenet’s multifaceted business model, and crucial contributions to healthcare, it is a strong bet to recover along with the greater healthcare industry and the US economy. While Tenet Healthcare is down ~23% YTD to September 16, it has performed significantly better than some of its competitors in the prior year, as compared to HCA Healthcare (HCA), Universal Health Services, Inc. (UHS) and Acadia Healthcare Company, Inc. (ACHC), as pictured below.

While other healthcare stocks have performed better, and those with lots of exposure to hospitals have largely suffered, just basing any evaluation of Tenet on this is misleading. Unless healthcare stocks focus on telemedicine, innovation, or biotech, they have been largely hurt from COVID. One of the major byproducts of COVID were patients cancelling elective procedures and appointments, with hospitals losing significant revenue as a result. However, as things get back to normal, and normal hospital operations return, stocks such as Tenet Healthcare, which has already been pursuing strategic initiatives to recover, should perform well.