Summary

- For a low volatility stock like AT&T, there is certainly a lot of heated debate.

- Q2 earnings were about what was expected and the stock continues to be in a stable range.

- Any talk of the dividend being in jeopardy is madness.

- It may trade like a glorified bond right now, but when things improve and debt is reduced, there is the potential for capital gains.

- Looking for a helping hand in the market? Members of BAD BEAT Investing get exclusive ideas and guidance to navigate any climate. Get started today »

- Prepared by Stephanie of team BAD BEAT Investing

AT&T (T) is currently trading moderately lower following its highly-anticipated Q2 earnings report. This report comes after we highlighted the stock as one to buy following the COVID-19 fallout a month ago, in March, when shares had been pummeled to 52-week lows. We laid out expectations, and while there is a lot of pain for major companies, AT&T gave us some reasons to be positive. Make no mistake, there are few stocks that trade with such little beta as AT&T, yet draw praise and ire from a diverse investing community. Frankly, right now, it trades like a glorified bond. Relatively stable range, high-yield. It is great for income and for dividend reinvestment. Thankfully, it has more than just wireless activity and is a bit diversified, but, obviously, a locked-down world is not good for its business. We saw this in its entertainment line (i.e. WarnerMedia). We need to get through this so that we can start to analyze the company more directly once again. We continue to see immense challenges for AT&T's operations for the next few months. Make no mistake, it has been a chaotic few months for all of us, our families, and our nation. The COVID-19 pandemic had a significant impact to AT&T's performance, along with so many other stocks. But if we set the COVID-19 impact aside for a moment, the second quarter was pretty much what we had expected and was decent. All things considered, we still love buying the stock in the $20s with a safe dividend that is yielding over 7%.

Top-line pressure remains

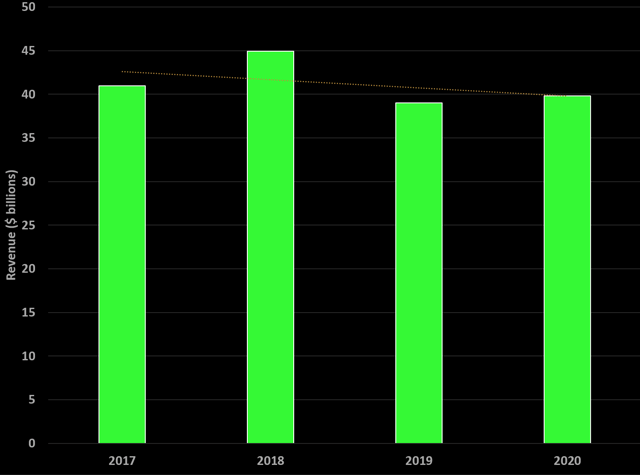

Revenues had begun to flatten for the company until Time Warner's assets were brought under the AT&T umbrella. We are seeing the positive impact, but revenues in Q2, which really got hit hard by COVID-19, showed contraction from a year ago as expected:

Source: SEC Filings, graphics by BAD BEAT Investing

All in all, our revenue expectations were slightly more conservative relative to the pack. Analysts covering the company were targeting a consensus of $44.15 billion. Overall, we were looking for revenue to decline to about 7-11% or so and to come in somewhere in the $39.3-41.1 billion range. Revenue hit $40.9 billion at the higher end of the range. However, the posted result of slightly below consensus estimates by about $25 million. In fairness, it was really tough to handicap this quarter for many industries, including AT&T's massive global telecommunications operation.