- Triumph Bancorp, Inc.'s new preferred stock, TBKCP, is trading 4% below its par value.

- Triumph Bancorp is a small Texas-based bank with a market cap of $565M.

- TBKCP has the highest Yield-to-Worst when compared to the other fixed-rate preferred stocks, issued by a regional bank.

- TBKCP market capitalization is not enough for the preferred stock to be included in the largest fixed-income ETF's holdings.

- I do much more than just articles at Trade With Beta: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Introduction

In terms of the US regional banks, we are in a real boom after the COVID-19 crisis, as from a total of 18 preferred stocks issued since May, 12 are offered by a regional bank. In this article, we will present the newest fixed-rate Preferred Stock IPO, issued by the Texas-based Triumph Bancorp, Inc. (TBK).

The New Issue

Before we submerge into our brief analysis, here is a link to the 424B5 Filing by Triumph Bancorp, Inc. - the prospectus.

Source: SEC.gov

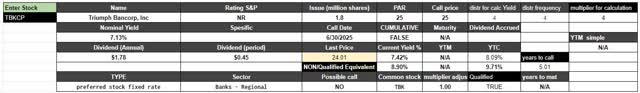

For a total of 1.8M shares issued, the total gross proceeds to the company are $45M. You can find some relevant information about the new preferred stock in the table below:

Source: Author's spreadsheet

Triumph Bancorp, Inc. 7.125% Series C Fixed Rate Non-Cumulative Perpetual Preferred Stock (TBKCP) pays a qualified fixed dividend at a rate of 7.125%. The new preferred stock has no Standard & Poor's rating and is callable as of 06/30/2025. TBKCP is currently trading below its par value at a price of $24.01. This translates into a 7.42% Current Yield and a YTC of 8.09%.

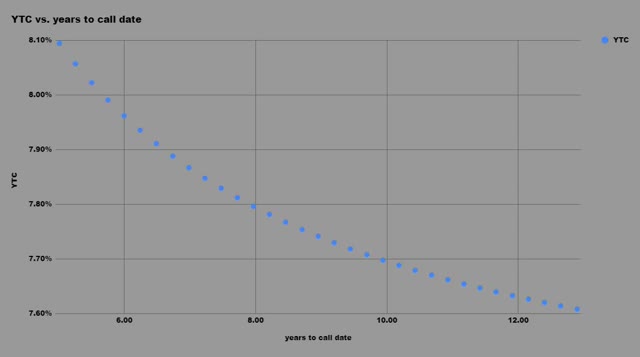

Here's how the stock's YTC curve looks right now:

Source: Author's spreadsheet

The Company

Triumph Bancorp, Inc. (TBK) is a financial holding company headquartered in Dallas, Texas, with a diversified line of community banking and commercial finance activities. Our bank subsidiary, TBK Bank, SSB, is a Texas-state savings bank offering commercial and consumer banking products focused on meeting client needs in Texas, Colorado, Kansas, Iowa and Illinois. We also serve a national client base through our Triumph Commercial Finance division, which offers factoring, equipment lending, asset based lending, and premium finance solutions for independent insurance agents. We also offer discount factoring through Advance Business Capital LLC, d/b/a Triumph Business Capital and insurance through Triumph Insurance Group, Inc.

Company's website | Corporate Profile

Below, you can see a price chart of the common stock, TBK:

Source: Tradingview.com

We have not historically declared or paid any cash dividends on our common stock since inception. Holders of our common stock are entitled to receive only such cash dividends as our board of directors may declare out of funds legally available for such payments. Any declaration and payment of dividends on common stock will depend upon our earnings and financial condition, liquidity and capital requirements, the general economic and regulatory climate, our ability to service any equity or debt obligations senior to the common stock and other factors deemed relevant by the board of directors. Furthermore, consistent with our business plans, growth initiatives, capital availability, projected liquidity needs and other factors, we have made and will continue to make, capital management decisions and policies that could adversely impact the amount of dividends, if any, paid to our common stockholders.

Source: Company's 2019 Annual Report

In addition, with a market capitalization of around $565M, Triumph Bancorp takes place as one of the smallest 'Regional Banks' (according to Finviz.com).