Summary

- Dell's latest quarter benefits from COVID-19 tailwinds, though trends have begun to normalize in April.

- PowerStore has also seen encouraging initial traction.

- The liquidity position is strong, and the deleveraging path remains on track.

- At c. 8x EBITDA, the valuation seems undemanding.

At the current c. 8x CY21 EBITDA multiple, Dell (NYSE:DELL) seems fairly undervalued on a whole-company basis, especially considering the firm still has solid growth potential at hand. More importantly, I believe Dell is on track to pay down its debt load, and as such, shares should eventually benefit from a multiple re-rating as the company de-levers.

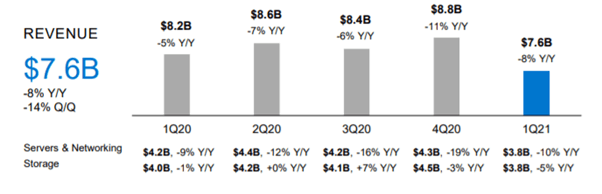

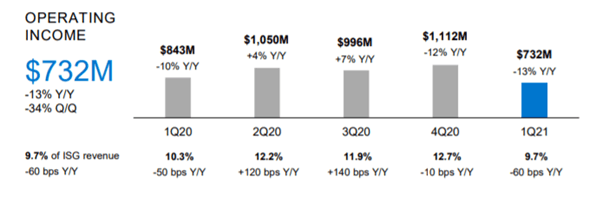

Work-From-Home Shift Drives Strength in Servers and Storage

The Infrastructure Solutions Group (ISG) segment may be in secular decline, but 1Q '21 servers/networking revenue at $3.8 billion (-10% Y/Y) and storage revenue at $3.8 billion (-5% Y/Y) surprised to the upside as COVID-19 drove demand strength for Dell's mainstream servers. As the better-than-expected ISG trends largely reflect order pull-ins in the enterprise segment, however, I would be cautious about the sustainability of this strength heading into the upcoming quarters.

Source: Q1 '21 Presentation

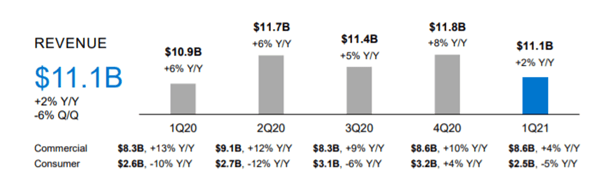

CSG Also Received a Timely March Boost Prior to April Fade

Similarly, the shift to remote work/learning demand in March lifted Dell's Client Solutions Group (CSG) sales to $11.1 billion (+2% Y/Y), well above consensus estimates. Within the segment, Commercial outperformed, rising 4% Y/Y relative to Consumer, which declined 5% Y/Y. This trend was also reflected in the volumes, as commercial notebooks and mobile workstations rose double digits and high-single digits, respectively.

Source: Q1 '21 Presentation

The resilient sales came in stark contrast to Hewlett Packard Enterprise's (NYSE:HPE) commentary over the same period, as Dell more successfully navigated supply chain challenges for the quarter. By comparison, HPE had pointed toward supply constraints being a c. $700 million headwind, primarily in its Compute segment. Dell did not suffer such constraints, but did add some cost during the period, which, in addition to a mix shift to government/commercial, lowered the segmental margin by c. 200bps Y/Y. According to Dell, on the quarterly call, this surge has already begun to fade in April, and as such, I would pencil in a normalization beginning in Q2 '21.

Source: Q1 '21 Presentation

Near-Term Outlook Appears Challenged, But Deleveraging is On Track

Dell did not provide quarterly guidance per usual (Dell only guides annually), but management did caution that IT spending is expected to be down 5%-10% Y/Y. As a result, next quarter's revenues are also set to grow below the typical seasonal +6-8% Q/Q. Dell's caution also extends to the bottom line, with an opex reduction plan in the works. While the commodity situation could prove to be inflationary and become a headwind in upcoming quarters, the impact likely depends on the final demand situation in the quarter. I would note that commodity pricing has been a lesser tailwind this time around than it was in the previous quarters. Encouragingly, Dell did also reiterate confidence in its target to pay down debt by c. $5.5 billion for fiscal 2021, which would entail a c. 20-30bps reduction to net debt/EBITDA (currently at c. 3.8x) for the year.

| Q1 '20 | Q2 '20 | Q3 '20 | Q4 '20 | Q1 '21 | |

| Net Debt/ Total Capital | 1.0x | 0.9x | 0.9x | 0.9x | 0.9x |

| Net Debt/TTM Adj. EBITDA | 4.2x | 3.8x | 3.8x | 3.6x | 3.8x |

Source: Company Data

PowerStore is a Solid Addition to the Storage Line Up

In early May, Dell also unveiled a new line of mid-tier storage products (PowerStore), which sits below the higher-end PowerMax, but above UnityXT and PowerVault, the latter of which is an entry-level offering. According to Dell, PowerStore offers over 3x data reduction, up to 125% more bandwidth, and over 5x faster provisioning. Additionally, the integration capabilities with the VMware ESXi Hypervisor, along with its CloudIQ monitoring capabilities, also serve as key product differentiators.