Summary

- The company recently raised more than $200 million (before expenses) through the sale of common shares.

- The borrowing commitment for the bank line was reduced a minimal amount.

- Profit margins are outstanding.

- Leverage is on the high side of reasonable.

- The debt due schedule is very favorable.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Get started today »

The liquidity at Comstock Resources (CRK) was getting a little on the tight side. So, this management did what many successful managements have done in the past. The company sold about 40 million shares of stock to gain additional liquidity before Mr. Market became concerned enough to decimate the stock price. Most likely, the option to sell an additional six million shares will be exercised.

"Following the end of the quarter, the Company completed its scheduled semi-annual borrowing base redetermination under its revolving bank credit facility, resulting in the bank group decreasing the borrowing base from $1.575 billion to $1.4 billion. The commitment level was reduced from $1.5 billion to $1.4 billion. The decrease is related to lowered oil and natural gas prices that the banks used to determine the borrowing base."

Source: Comstock Resources First Quarter 2020, Earnings Press Release

Out of all of the above quote, the very important part is the amount the banks committed to lend. The borrowing base itself means very little to the average investor and really can be ignored. Even the committed lending amount is often limited by covenants. Any requested loan that would cause a covenant violation would not occur regardless of lender commitments.

That decrease in lending commitments may have made management feel that additional liquidity was necessary for the company to operate properly during the coronavirus challenges. Natural gas prices are the beneficiary of decreased oil production. Therefore, there is a very good chance that the next adjustment of the loan commitment will be upwards.

Leverage

Still, the oil and gas industry is very volatile and unpredictable. Conservative managements have long solved problems quickly rather than waiting for the problem to resolve itself or get worse. Too many times, an unresolved challenge becomes more daunting.

Source: Comstock Resources May 2020, Investor Presentation

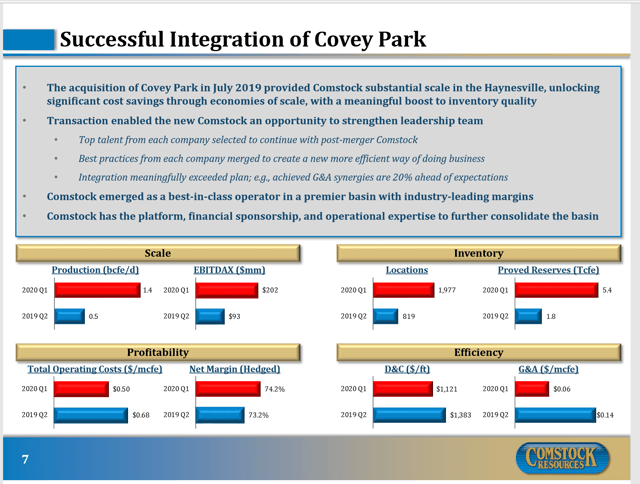

Production nearly tripled from the year before, thanks to a solid acquisition. But natural gas prices declined substantially, so that the profits reported in the first quarter were comparable to the profits reported in the first quarter of the previous year. Most of the profit gain was due to a swing in hedging from a loss to a gain. Adjusted net income as reported by management only increased roughly $6.4 million.

EBITDAX did double in the first quarter. But that was less than anticipated because the natural gas price decline did decrease revenue, earnings, and cash flow. The hedging program did offset some of the decline, but the effect clearly shows in the slide above.

Management kept the margin in good shape by trimming costs. The acquisition was supposed to result in economies of scale. That appears to have happened. However, the results "hid" that economies of scale progress when natural gas prices further weakened.