Summary

- AT&T has an impressive portfolio of assets with the ability to generate significant FCF. The transformation is almost complete.

- AT&T is reorganizing its capital stack and just because COVID-19 has halted repurchases doesn't mean they won't restart.

- The launch of HBO Max has the potential to generate the company billions in annual FCF.

- Take advantage of the drop in share price and invest now.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

AT&T (NYSE: T) has, over the past few years, made a significant transformation from a telecom company. The company now has an enterprise value of roughly $350 billion, of which $200 billion is its market capitalization. That enterprise value includes the company’s $50 billion DirecTV acquisition and $85 billion Time Warner acquisition, meaning the company’s entertainment acquisitions make up almost half of the company.

As the company is close to releasing HBO Max, which will come out in <21 days, let’s discuss this company going forward, and why it’s a great investment.

AT&T-Time Warner Financial Benefits

AT&T has already racked up significant financial gains from the $85 billion acquisition of Time Warner, which should continue to benefit the company going forward.

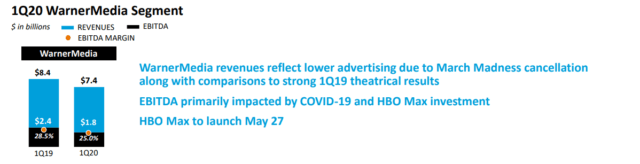

AT&T 1Q 20 Results - AT&T Investor Presentation

AT&T’s Time Warner division had a tough quarter as a result of financially successful one-offs in 1Q 2019 along with theatrical impacts that also helped support 1Q 2019 results. However, the business has continued to be incredibly profitable, even without the HBO Max launch. The company’s lower 1Q 2020 earnings still annualize at almost $30 billion with almost $8 billion in EBITDA.

Across the company’s business, in 2019, the company earned $150 billion in revenue, $60 billion in EBITDA and $30 billion in FCF. In the same sense, the company’s annual EBITDA from its Time Warner results come out to roughly $4 billion in annualized FCF. That’s some strong FCF for an $85 billion acquisition, especially at a time when the debt for the deal might only cost $1-2 billion annualized.

It’s also worth noting that the FCF doesn’t count the significant capital spending the company is currently undertaking. Warren Buffett likes to say that capital spending will come back into the business and owners eventually, as long as the company has a valid return on capital employed. The company’s return on capital employed is roughly 6% - so that’s significant from the $4 billion.

As can be seen, the Time Warner deal has already had significant accomplishments.