Summary

- Exxon Mobil is a potential gem of a trading opportunity with a number of attractive fundamental characteristics.

- Exxon Mobil has been a chronic under performer for years and risks being a value trap.

- Combining fundamental and technical analysis enable both traders and investors to pursue clearly-defined total return opportunities in Exxon Mobil.

- Looking for a portfolio of ideas like this one? Members of Global Macro Research get exclusive access to our model portfolio. Get started today »

It's a trading opportunity a decade in the making. When exploring for investment opportunities, it's a rare gem to find a company stock that is offering financial quality, low-price volatility, attractive value, prodigious cash flow generation, generous yield, and champion caliber dividend growth that's increasing capital spending with the aim of generating double-digit annualized earnings and cash flow growth through the middle of next decade. Exxon Mobil (NYSE:XOM) is a stock that checks all of these boxes at the present time.

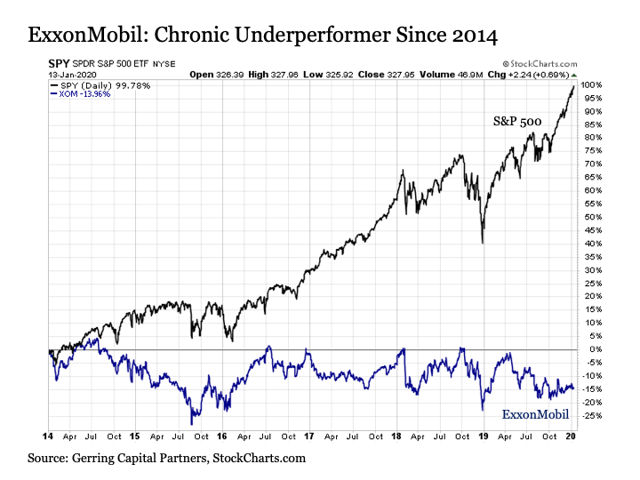

Exxon Mobil has been a chronic underperformer for years. The total return chart of Exxon Mobil relative to the S&P 500 Index over the past six years shown below says it all. For while the S&P 500 Index has doubled since the start of 2014, energy giant Exxon Mobil has fallen by -15%. The company stock has trailed for good fundamental reasons, including declining annualized revenue and earnings growth as well as highly volatility underlying oil prices. This raises an understandable question – despite all of the virtues previously mentioned, is Exxon Mobil a dreaded value trap?

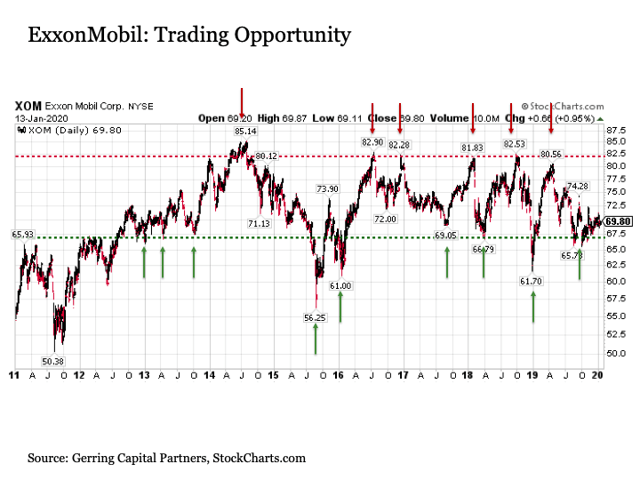

An attractive trade in a high-quality name. Complementing the fundamental case for Exxon Mobil is its attractive technical set up. This helps protect investors against this value trap risk as investors can own Exxon Mobil today with a short-term trading perspective with a clearly defined downside limit while maintaining the option to continue owning Exxon Mobil into the long term if its ambitious capital spending plans show signs of achieving future growth objectives. With this technical set up in mind, consider the following chart below.

A predictable long-term trading range. After testing the $67 dividend adjusted price level for more than 18 months since the start of 2011, Exxon Mobil shares finally broke out above this level in the second half of 2012. In the more than seven years since, the stock has been locked in a consistent trading range.

On nine different occasions since 2012, Exxon Mobil stock tested support at $67 per share. At times, the stock traded below this level for a spell. But in each past instance, Exxon Mobil shares responded to this support level and bounced higher.

Conversely, on six different occasions since 2014, Exxon Mobil stock tested what has become resistance at $82 per share. At times, the stock traded above this level for a short period of time. But in each past instance, Exxon Mobil shares were turned back at this resistance level and headed back lower.