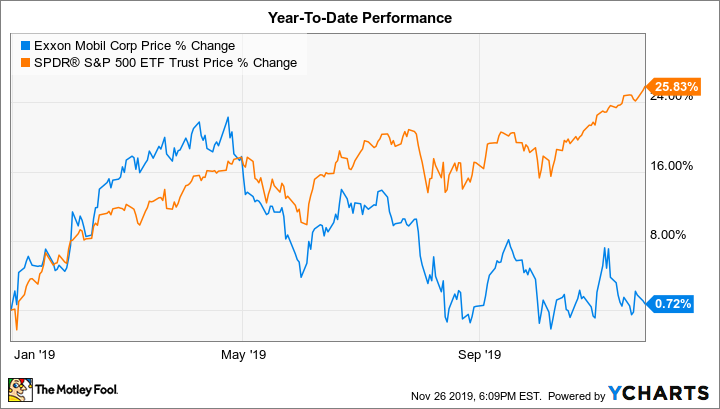

After an abysmal end of 2018 that sent the S&P 500 down nearly 15% in the last quarter of the year, the market has been on an absolute tear and is poised to enter the holiday season in very favorable standings.

ExxonMobil (NYSE:XOM) hasn't had the same amount of fun. The stock is actually down for the year as it sits on the shore and watches the party boats sail by. But that underperformance, in today's market, is one reason you could be smart to buy this energy stock for 2020 and beyond.

Take advantage of fear

Warren Buffett, one of the undisputed greatest investors of all time, famously said to "be fearful when others are greedy, and greedy when others are fearful." That advice illustrates the approach investors could take toward ExxonMobil: 10 years ago, Exxon was the largest company in the S&P 500; today, it is the 12th largest.

One of the biggest challenges for ExxonMobil has been adjusting to the new reality of $50 to $70 oil. The company has spent a great deal of effort expanding its portfolio toward investments that can break even at a lower oil price. One such place is the Permian Basin, the largest oilfield in the United States by production.

IMAGE SOURCE: GETTY IMAGES.

A Permian player

Over the past few years, ExxonMobil has been increasing its exposure to U.S. onshore plays that utilize hydraulic fracturing and horizontal drilling to break into tight shale formations. The technology has been around for decades, but until recently, many projects were financially unfeasible.

In addition to its rising upstream portfolio, Exxon has the second-largest refining capacity in the world and the largest coking capacity of any supermajor, which means it can break down heavier crudes containing longer hydrocarbon chains into usable products. Exxon's production out of the Permian feeds nicely into its vast downstream refining infrastructure along the Gulf Coast, especially now that much-needed pipelines to the coast are starting to come on line.

An innovation leader

In late November, Exxon was listed in fifth for innovation in the Management Top 250 ranking by the Drucker Institute at Claremont Graduate University. As the only nontech company in the top five, Exxon got the award largely for its patents and efficiency improvements to its oil and gas operations. Unlike other supermajors that are divesting away from oil projects and into natural gas, liquefied natural gas (LNG), and renewables such as wind and solar, Exxon is mostly sticking to what it does best by making oil and gas more profitable and less harmful to the environment.

According to Exxon, the company's efforts on carbon capture and storage (CCS) have "accounted for more than 40 percent of cumulative CO2 captured" since 1970. CCS technological innovation is a way for oil and gas companies to participate in reducing greenhouse gas emissions while still dealing in the business of hydrocarbons.

CCS and other environmental efforts are important for Exxon since it is betting big on the future of oil and gas, and thus will benefit from proving that it is dedicated to a sustainable energy future.

The dividend yield

A silver lining for a falling stock price is a rising dividend yield, especially for a company that has a history of increasing its payout. Exxon is one of those companies, as it now yields a robust 5%, which is nearly triple the yield of an S&P 500 ETF. Exxon's management has a reputation for raising the stock's dividend, which has increased more than 100% over the past 10 years.

XOM DIVIDEND DATA BY YCHARTS.

An investment worth considering for 2020

Now could be a great time to consider ExxonMobil. Dividend stocks like Exxon provide a return that can be valuable to investors who think the market will stall near its current all-time high, thereby making a shift into dividend stocks and away from stocks that rely solely on capital gains a savvy investment strategy. The fact that Exxon has missed out on the meteoric stock market rise of 2019 and retains a below-market valuation gives investors another reason to consider a position in this value stock.