Summary

- Dell continues to maintain leadership in its core areas and is aggressively expanding into new ones.

- The company has tempered its long-term growth targets a bit and is now in line with the industry growth; however, profitability remains strong.

- Company leadership and management are strong, and I expect them to deliver on their long-term value creation vision.

- Shares are relatively inexpensive at ~11x EV/EBITDA.

Dell Technologies (DELL) looks to be on the right track, delivering strong growth numbers and steady margin improvements thus far. If the latest business update is anything to go by, the company should continue to retain/improve on the strength of its recent results. Management's focus on delivering shareholder value is a key positive; despite its market leadership across its core segments, Dell is not sitting back and is consistently investing in innovation via R&D and acquisitions, investments as well as partnerships. Shares are relatively inexpensive at ~11x EV/EBITDA (vs peer average at ~14x) and with expectations now lowered following the top-line guidance cut, Dell looks like a value buy at current levels.

Driving Shareholder Value

Dell's recently held a "Business Update" event largely focused on its value creation plans. Management highlighted five key levers to drive long term value creation - improving current operations, leveraging synergies, exploring new opportunities, and optimizing the corporate as well as capital structures).

Source: Pg 11 of Business Update Presentation

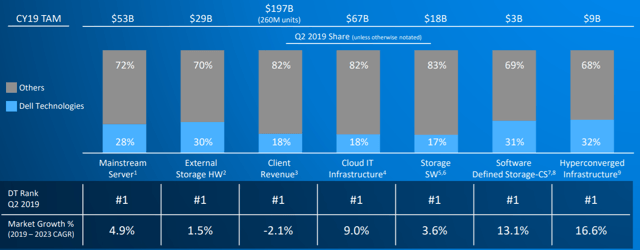

The focus on value creation has paid off thus far - in Dell's core markets, it has been steadily increasing its market share, and now holds leadership positions across its core markets. Of note, the company holds a dominant position in high growth markets such as software-defined storage (31%) and hyper-converged infrastructure (32%).

Source: Pg 25 of Business Update Presentation