Summary

- Our longer-term investment recommendations focus most often on dividend growth investment.

- AT&T shares have returned 30% plus since we pounded the table under $30, and we believe that momentum in the chart will continue.

- Everyone thinks the involvement of Elliott has been 'the catalyst', but we argue leverage reduction has played an important role as risks decline.

- A growing and safe dividend, you can collect a solid 5.5% yield even after the run-up in shares.

- Looking for a helping hand in the market? Members of BAD BEAT Investing get exclusive ideas and guidance to navigate any climate. Get started today »

Although our firm is perhaps best known for spotting short term, fast-moving trades in addition to deep value investing, our longer-term investment recommendations focus most often on dividend growth investment. For the last two years, we have strongly recommended that our readers accumulate shares of AT&T (T), especially when shares were below $30. With shares having returned 30% from these levels, what are investors to do now? We believe the stock is set to continue rising because necessary steps are being taken to address the largest issue the bears always cite: debt. Further, we believe the dividend will continue to grow, and while we certainly understand the desire to 'wait for a better price,' this is a stock you should own for decades. Let us discuss.

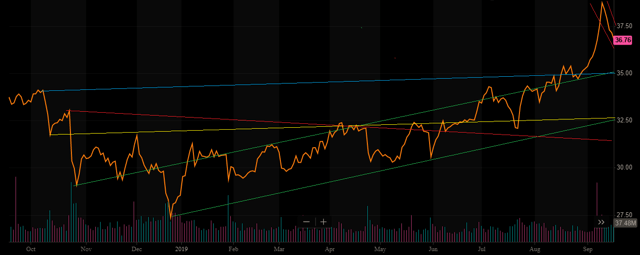

The funny thing about AT&T after our traders netted 30% is that we want people to still consider this name. Even after this monster run, the chart looks fantastic:

Source: BAD BEAT Investing

Bottom line, the stock is in a very bullish uptrend. The momentum us very positive, but had been even before the recent runup that began in late August.

Not only does the chart look stellar, but even at $37 per share, AT&T is still a high dividend yield stock. While the allured of the dividend may have been more compelling at past levels, a solid 5.5% yield will compound into very generous returns over time.

Of course, we are really do not want shares to fall again, but they were an incredible buy when the stock was yielding 7%. We believe here at $37 a share, the stock is still a moderate buy, but much prefer you add at a better price. At a 5.5% yield, the stock is definitely attractive from an income standpoint and is certainly attractive if you are reinvesting dividends to grow a sizable position over time.

The power of the dividend itself for building wealth has been established by our firm several times. As we approach another earnings season which could serve as a catalyst, we think it is prudent to remind you that, in the long term, this is a dividend growth machine. That said, we think monitoring the dividend coverage as well as how AT&T is handling debt are paramount to considering an investment quarter to quarter. It is still our opinion that every investor who needs a stock like AT&T.