Summary

- AT&T received a letter from activist investor Elliott Management that outlined a detailed plan for a turnaround.

- The company has failed to retain market share, grow earnings consistently, and integrate its past massive acquisitions.

- The cheap valuation and a high dividend yield, despite being attractive, will remain so unless the company tries to instill real change.

Elliott Management has taken an activist stake in AT&T (T) and the fund sent a letter to the board of directors of the company that outlines a plan to capture value. With it comes details as to how the company can pick its stock up out of its multiyear rut and finally deliver outperforming returns to shareholders. The core of the letter is rooted in AT&T stopping its growth by acquisitions strategy and to extract synergies from the previous businesses it has acquired. Elliott placed a $60 price target on the stock, to be reached by 2021, which is attainable, if the company follows the plan.

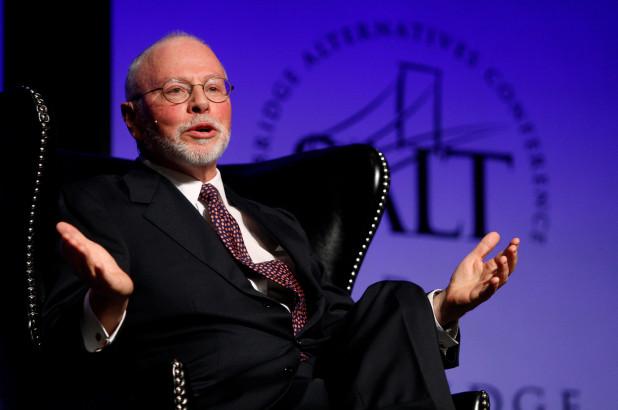

Source: NY Post

Complying With Elliott's New Plan

Elliott’s activist stake is worth about $3.2 billion at current market prices. With it comes a letter to AT&T suggesting that changes need to be made (some easier than others) in order to improve profitability, take back market share in certain business units, and create a more efficient organization that can deliver value for shareholders. The key points from the letter are the following:

- 65%+ upside is achievable ($60 per share price target) by the end of 2021

- AT&T's track record for delivering shareholder returns is "disappointing"

- Operational and strategic setbacks have caused shareholder value to be inadequate, leading to massive underperformance relative to both peers and the market

- The company's assets need to undergo a comprehensive review to determine which can be divested, such that cash can be used to accelerate investments and returns to shareholders

- M&A needs to stop as the company has yet to extract value from past mega-acquisitions

AT&T management's response was rather simplistic, stating that they will look at the proposal Elliott has made. They expect to have future engagement with Elliott, but provided this backhanded statement: "Indeed, many of the actions outlined are ones we are already executing today." I'm sure both shareholders and Elliott would disagree or they wouldn't be in this situation. The letter from Elliott also comes at a an interesting time. Just two weeks ago, the company announced that the current CEO of the Communications unit, John Donovan, is set to retire on October 1. The Communications unit is the largest single division of the company, responsible for a majority of revenues. The company quickly named a replacement, John Stankey, who is the current CEO of Warner Media.