Summary

- AT&T has a logical path to improve their share price.

- Elliott Management predicts improving operations and committing to capital allocation plans provide a total return of $60 by 2021 for 50%+ upside.

- The activist targets reasonable forward P/E of 12x and the dividend yield dipping to 4.0%.

- Management has reportedly hired Goldman Sachs and doesn't appear out of the empire building process that will cap the stock around $40.

After a decade of underperformance, Elliott Management is applying pressure to AT&T (T) to make operational changes and to focus on capital returns to shareholders. The activist further highlights my previous investment thesis that the stock has struggled due to empire building and in the process creating a business that is too hard to manage. The $60 price target is unrealistic with the current management team in place leaving a move to the low $40s as the more likely outcome.

Image Source: Activating AT&T website

The Plan

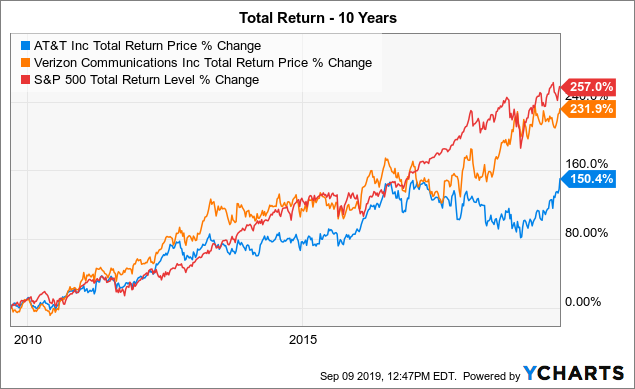

The Elliott management plan is for AT&T to essentially focus on improving operations via cutting overlapping costs and selling off non-core assets. The activist uses the Verizon Communications (VZ) example of becoming more focused over the last decade, where as AT&T took the wrong path of diversification. The end result is that Verizon has far outperformed AT&T in the last decade while both have underperformed the benchmark S&P 500 index.

Data by YCharts

Data by YChartsSince 2010, Verizon has gone from a 60% focus on wireless to 71%. The company has even dabbled with content creation and online advertising during the period. Those moves likely contributed to even Verizon underperforming the market by about a percentage point a year in this last decade.

In comparison, AT&T has shifted from a 47% wireless business to 38% wireless while the company didn't move to exit the wireline business. The company now has 40% of the business in categories such as video, content and Latin America that weren't present in 2010.

Elliott Management sees AT&T having the potential of reaching $60 from following the below strategic plans. For the most part, the plan is to shift focus from large acquisitions to improving operations. The company would utilize all of the free cash flow after the dividend (around $14 billion now) to equally pay down debt and repurchase shares.