Summary

- JCP recently hired restructuring specialists.

- The company will likely look to restructure its massive debt load.

- Any scenario would likely be highly dilutive.

- Sell JCP.

This idea was discussed in more depth with members of my private investing community, Shocking The Street. Start your free trial today »

Source: Forbes

Shares of J.C. Penney (JCP) are under pressure. The stock is off over 45% over the past month amid chatter the company is looking to restructure its debt. The company recently divulged it hired restructuring specialists Kirkland & Ellis and Lazard:

Penney's latest debt advisers include restructuring specialists from law firm Kirkland & Ellis LLP and investment bank Lazard Ltd (LAZ.N), according to people familiar with the hires.

The firms, which had no comment, have worked on significant workouts with other retailers, including on a debt restructuring earlier this year for luxury clothier Neiman Marcus Group Ltd executed without the need for a bankruptcy filing.

I have been warning about J.C. Penney's less-than-optimal capital structure for months. It appears management wants to address the issue sooner rather than later. Here are my thoughts on the restructuring efforts.

Will A Debt Restructuring Help?

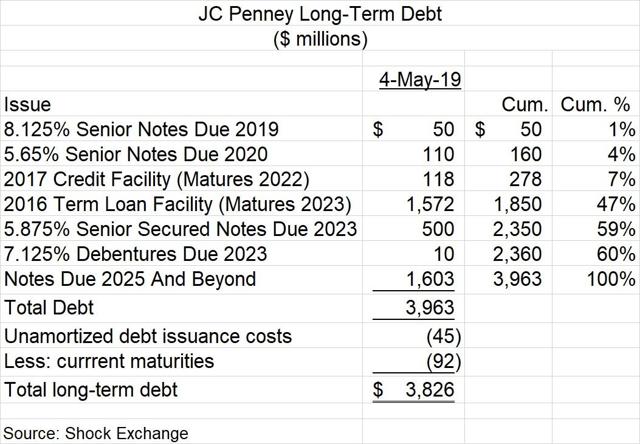

A debt restructuring usually involves a company negotiating with lenders to push its current maturing debt to outer years. A potential cascade of principal payments can cause liquidity strain for companies. The following chart outlines the company's $4 billion debt load by maturity.

In my opinion, management has already done a good job of pushing out its debt maturities. Over the next two-and-a-half years (through 2020), it only has $278 million of debt maturing. This represents about 7% of its total debt load. The benefit of pushing $278 million in payments into the outer years seems marginal.

There is a $1.6 billion term loan that matures in 2023. Restructuring efforts imply the company does not have the cash flow to repay $1.9 billion in principal by 2023. Secondly, if J.C. Penney needs to convince debt holders to delay principal payments due in over three years, then it may have bigger problems than shareholders realize.