Summary

- Exxon Mobil released Q2-2019 results last week.

- The results beat both revenue and earnings estimates.

- Exxon Mobil reported decreasing earnings on the back of lower price realizations and declining margins, but the company also benefited from strong production growth.

- Exxon Mobil is free cash flow-strong which points to growing shareholder distributions going forward.

- An investment in XOM yields 4.9 percent.

Despite a solid earnings beat last week, Exxon Mobil's (XOM) shares continued to sell off as fears over an escalating trade war between the United States and China weighed on investor sentiment. I think the drop is a good opportunity to add Exxon Mobil to a high-quality DGI portfolio as the company has exceptional free cash flow power and will continue to raise its dividend payout going forward. An investment in XOM yields a whopping 4.9 percent.

Exxon Mobil - Second-Quarter Earnings Review

Exxon Mobil released a mixed deck of second-quarter financials last week. The energy company reported total revenues of $69.1 billion in the second quarter compared to $73.5 billion in the same quarter in the year-ago period, reflecting a decline of ~6 percent. Exxon Mobil beat the consensus revenue estimate of $65.2 billion.

In terms of earnings, Exxon Mobil earned $3.1 billion in Q2-2019, 21 percent less than in Q2-2018 when the energy company reported $4.0 billion in quarterly profits. On a per-share basis, Exxon Mobil's profits totaled $0.73/share in the quarter ending June which compares against $0.92/share last year, also reflecting a decline of 21 percent. Wall Street was expecting the energy company to report profits of $0.66/share.

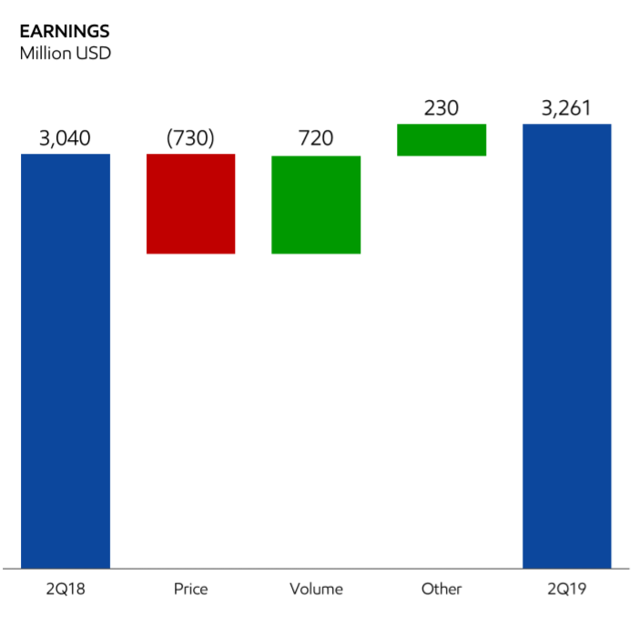

Exxon Mobil's year-over-year decrease in profits was driven by multiple factors, including lower price realizations and lower downstream margins.

Exxon Mobil's upstream earnings increased by about ~$220 million year-over-year as volume growth and other factors such as a one-time tax effect offset a decline in price realizations.

Source: Exxon Mobil Investor Presentation

Source: Exxon Mobil Investor Presentation

Exxon Mobil's downstream segment, on the other hand, reported a sharp drop in profits in Q2-2019, due to declining industry refining margins and scheduled downtime compared to last year. The downstream business posted profits of $451 million, ~38 percent less than in Q2-2018.