Summary

- There are many kinds of bearish narratives being peddled of late but market participants aren't buying them.

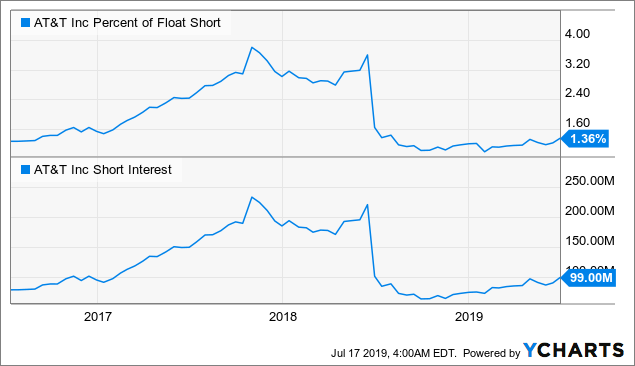

- Short interest data shows that traders and speculators aren't actively shorting AT&T.

- Investors and readers, too, should ignore the noise and focus on the company's long-term growth trajectory.

- Its 5G-related efforts could meaningfully drive the overall company's growth going forward.

AT&T (T) has been surrounded by mixed market sentiment of late while its shares continue to breach its 52-week highs. Many believe that its rally is over extended and a correction in its share price is long overdue. But the latest short interest data presents a rather interesting picture. As its shares continue to head higher, its short interest has barely risen and the metric is nowhere near its year-ago levels. This suggests that long-side investors should ignore the noise and stay long on the scrip. There may be a lot of bearish narratives relating to AT&T being peddled of late, but market participants aren’t actively shorting the stock. Let's take a closer look to have a better understanding.

(Source: Bigstockphoto, Image license purchased by author)

Short Interest Remains Low

Let me start by saying that short interest is essentially the total number of short positions that are open and are yet to be covered. A sharp rise in the metric would suggest that market participants are stacking short positions against a particular stock maybe because they feel the scrip will depreciate in value going forward. Conversely, a sharp decline in the metric suggests that market participants are covering their short positions perhaps because they no longer forecast the concerned stock’s price to meaningfully drop going forward. So, short interest is basically a gauge to measure the market’s sentiment about a stock.

Now let’s come back to AT&T. Its short interest amounted to about 99 million at the end of the last reporting cycle which rose from 90 million sequentially. While the figures may seem enormous when seen in isolation, they really aren’t in the grand scheme of things. Fact of the matter is that AT&T has about 7.3 billion shares outstanding which means that only about 1.36% of its shares stood shorted at the end of the last reporting cycle. While the figure rose compared to the prior cycle, the rise isn’t large enough to induce panic.

There are two reasons why I say this. First, AT&T’s short interest (on a percentage as well as on an absolute basis) has declined substantially over the last year. This only means that the metric still has a long way to grow before it's even considered to be a cause of worry.

Data by YCharts

Data by YChartsSecondly, its short interest as a percentage of overall floating shares is pretty low by industry standards. Other beleaguered telecom companies that are actually in a state of duress are attracting the bulk of shorting activity while AT&T remains one of the least shorted names in the industry.