Summary

- Exxon Mobil is now considering selling all its licenses on the Norwegian continental shelf, according to Norwegian media.

- The Norwegian Continental Shelf assets sale is expected to fetch between $3 billion and $4 billion according to experts.

- I believe it is the right strategical decision long term. However, the market may not like it because it will translate to lower production and revenues for the next several quarters.

Image: The Statfjord, a platform in the North Sea. (Photo: Harald Pettersen/Equinor ASA)

Presentation

US-based Exxon Mobil (XOM) is one of the most popular oil supermajors often considered as a "must own long term" in any savvy investor's portfolio with a stable dividend yield of 4.48%.

Exxon Mobil is an "integrated oil," which means that the company is present in every aspect of the oil and gas industry, from the upstream to the downstream and chemical.

The company owns meaningful onshore (e.g., Permian) and offshore projects (e.g., Australia, Africa, Guyana, Brazil, and recently Cyprus) that guarantee a constant production for years to come.

One crucial project/region for the company is the Stabroek Project in Guyanawhich will start production in 2020 with the Liza Phase I. The operator of the block is Esso Exploration & Production Guyana Ltd., a subsidiary of Exxon Mobil which owns 45% working interest.

The Upstream segment is the most relevant for the company, which is the exploration and production segment.

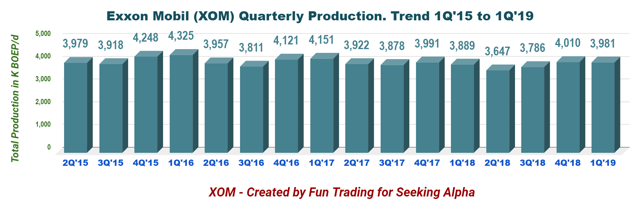

Exxon Mobil produced 3,981K Boep/d in 1Q'19.

If we look at the total production per day and compare to Exxon Mobil's main rivals, we quickly realize that the company is one of the most prolific oil and gas producers in the world. Not only for the total output but also if we look at the whole US or Americas production as well:

For instance, Exxon Mobil was producing 226K Boep/d in the Permian Basin in the first quarter of 2019 and expects to reach 1 Million Boep/d in 2024. It was below Chevron Corp. (CVX) which managed to produce 391K Boep/d the same quarter, but the company is still amongst the most prolific in this US region.

The first strategical decision made about exiting the Norwegian North Sea business started in March/April 2017 when Exxon Mobil decided to sell its operated fields on the Norwegian Continental Shelf to private equity firm HitecVision and its portfolio oil company Point Resources.