Summary

- AT&T's quarter allows management to continue with their plan of strengthening the balance sheet.

- Being close to a reasonable 2.7x leverage has allowed management to discuss another way to allocate free cash flow: buybacks.

- My calculations show that AT&T will be able to save millions of dollars a year by repurchasing its high yielding stock.

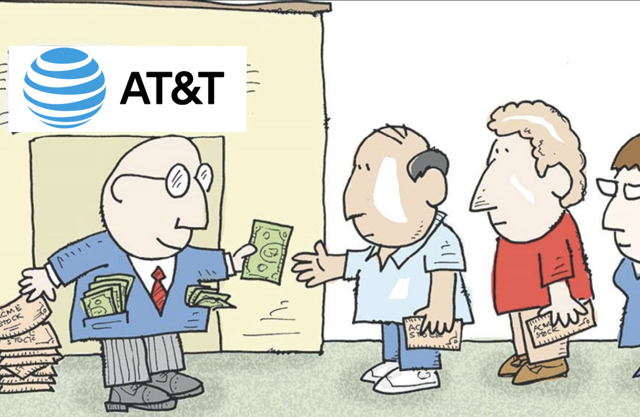

AT&T’s most recent quarter was just what investors needed: anticlimactic. EPS was more or less in line with estimates as was revenue, and management continued to execute its plan of reducing debt using its massive free cash flow. The stock market rewarded a management that did what was expected, and, more importantly, didn’t fall flat on its face. However, there was one line in one slide that caught me off guard, “Beyond 2.5x range, will consider opportunistic share repurchases while continuing to pay down debt.” At first, I just thought this was just management throwing investors a bone, so to speak, but it was further elaborated upon during the conference call:

“With regard to the balance sheet, I think, if you can think about as we talked about after the fourth year after the close of the deal. We look to be – I’d expect, we’d be somewhere around the 2.0 range or below that gives us great flexibility to pay down debt and take advantage of what now is a higher cash cost of equity capital than the cash cost of our debt capital.” - John Stephens

To get to a 2.0 leverage range, management would need to pay down debt to around $120 billion, which is still quite far from the current projections of $120 billion guidance by the end of the year. For me, that just furthered my initial feeling that the quote being just a bone; however, John Stephens revisited the idea later in the call:

“So, when you look at out of very methodical basis, right now, the cash flows of the overall operation on an after dividend basis can be enhanced by shifting some of your focus from debt repayment to buyback.” - John Stephens

AT&T Investor Slideshow

This was much more exciting for me as I love when companies repurchase stock, especially if I believe the company is trading well below its fair value, which I believe is the case here. However, I wanted to do more investigating into exactly how much the cash flows could be “enhanced” through stock buyback so I created two scenarios. First, a scenario in which AT&T strictly uses its remaining free cash flow (after dividends) to buy back stock. Second, a scenario in which AT&T uses its remaining free cash flow (after dividends) to repay debt. This is what I found: